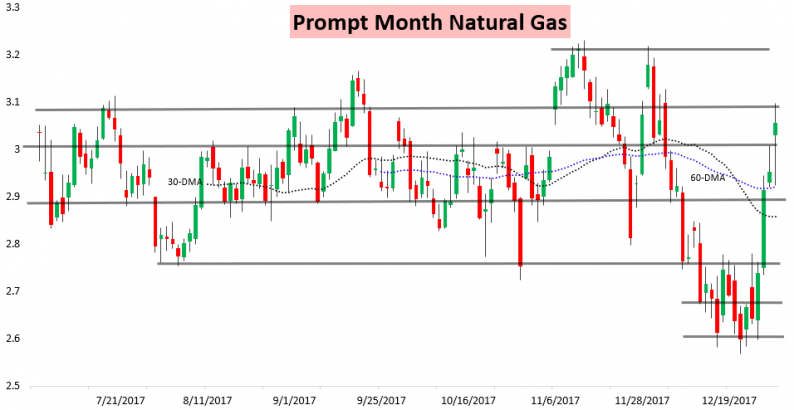

Natural gas prices were extraordinarily volatile today, gapping up significantly last evening before selling off overnight to close the gap and then rallying through the session again today.

Yet the main story today was Henry Hub cash, which rocketed higher, pulling the entire strip along with it. This came as short-term cold remains extremely impressive and natural gas demand set a daily record.

As can be seen, cash prices clearly held up the front of the strip today, with the front of the strip receiving far more support than later contracts.

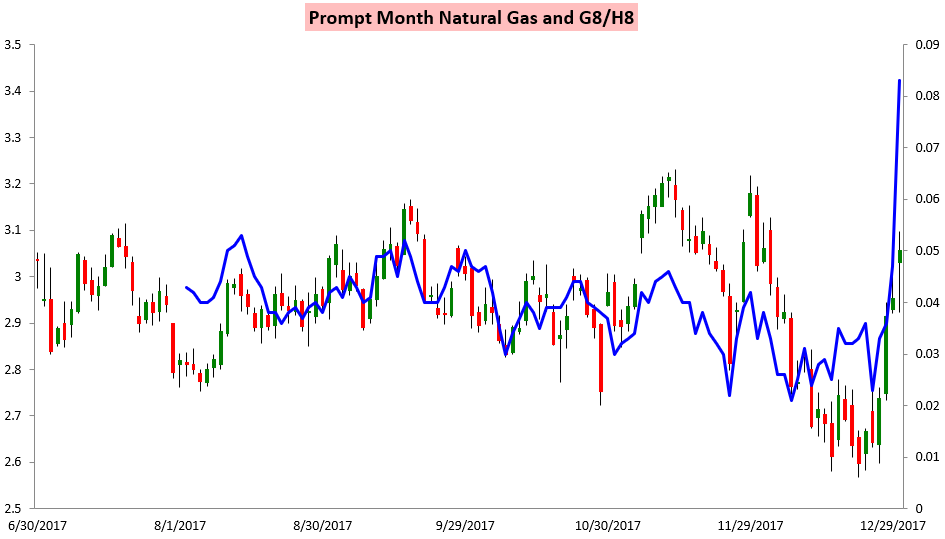

The impact of such strong cash prices can be even more clearly seen with the February/March G/H spread, which has shot higher the last couple of trading days as cash prices have soared.

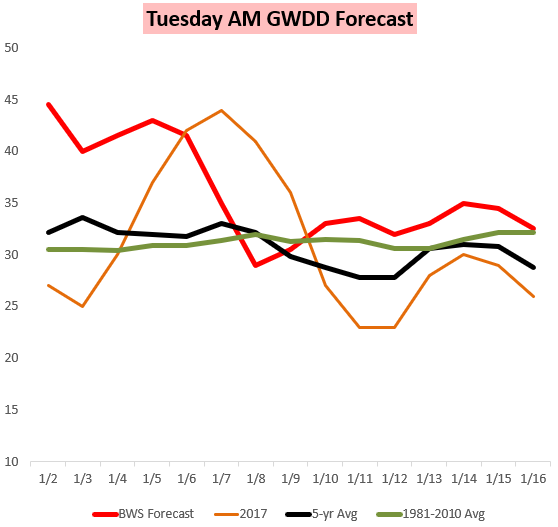

However, it is clear that GWDDs peaked yesterday, falling off a bit today and being solidly less impressive tomorrow. Another strong burst of cold comes in for the 5th and 6th, but from there we see them fall off further too, as seen in the forecast from our Morning Update below.

Yet there were significant changes in our afternoon GWDD forecast just released, as afternoon model guidance continued to bounce around. We registered much higher than average model volatility in the long-range again, as can be seen in a significant shift colder in the afternoon American GEFS ensembles in the 8-14 Day time frame (courtesy of the Pennsylvania State Electronic Wall site).

Leave A Comment