The rumors about the possible liquidity crisis for the world’s third-largest crypto exchange turned out to be true. Just a day after assuring funds are fine, and they have the assets to back customer’s funds, FTX CEO Sam Bankman-Fried (SBF) announced on Tuesday that Binance has shown intent to acquire the global crypto platform to help with the liquidity crisis.

The liquidity crunch came as a surprise to many, given FTX bailed out numerous firms during the crypto contagion caused by the downfall of LUNA and the insolvency of 3AC.

Even as the crypto community process the events of the past 24 hours, the focus has now shifted toward other SBF-owned entities, especially Alameda Research, a leading principal trading firm. Alameda and FTX merged their venture capital operations in August 2022. Speculation mills are rife that Alameda reportedly faced a crisis itself during the crypto contagion in the second quarter and FTX bailed it out, which eventually came to bite it back.

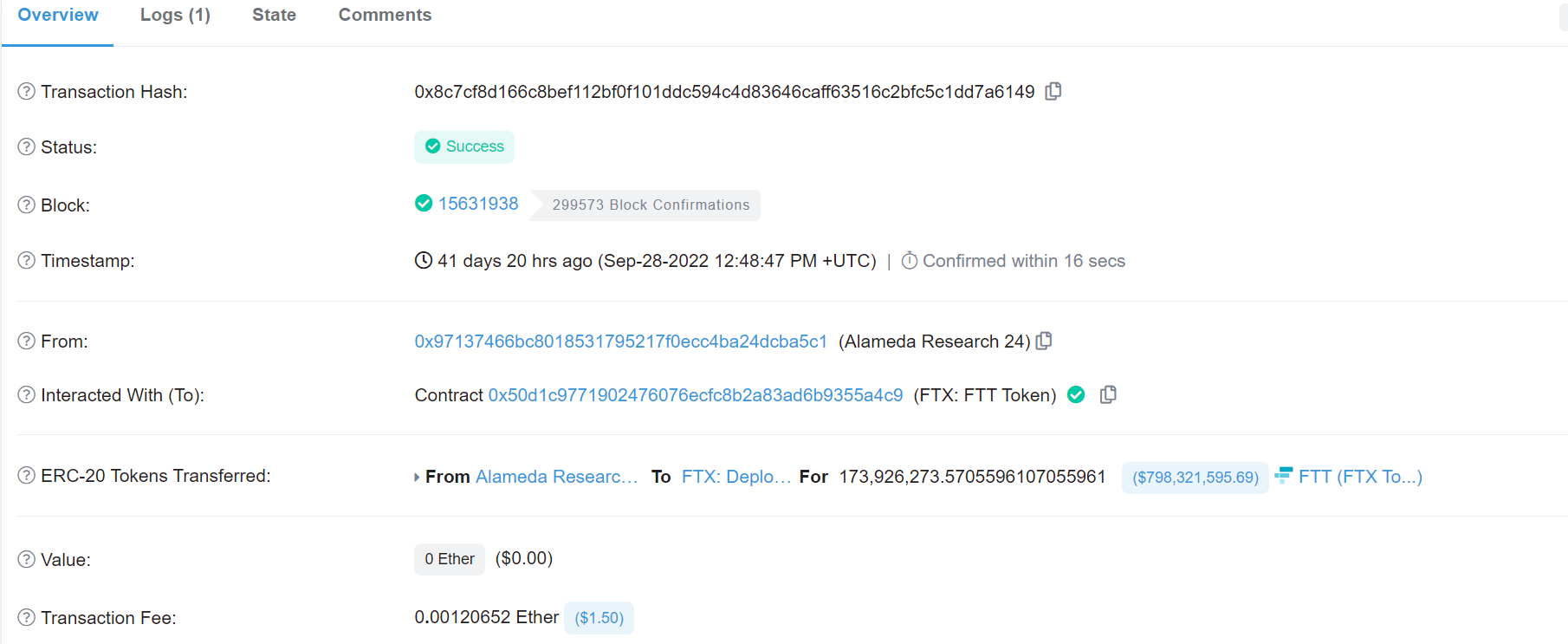

Lucas Nuzzi, the head of the crypto analytic firm Coinmetric, took to Twitter to point out the FTT market cap increased 124.3% on September 28 when 173 million FTX Token (FTT) worth over $4 billion became active on-chain. Nuzzi pointed out that on the same day, a total of $8.6 billion worth of FTT tokens were moved on-chain.

Related: SBF tumbles off Bloomberg’s billionaire index after trouble at FTX

Tracking the fund transfers of the day, Nuzzi found 173 million FTT tokens from a 2019 ICO-era contract and the recipient of the $4 billion mint was reportedly Alameda Research.

4/ The recipient of the $4.19 B USD worth of FTT tokens was no one but Alameda Research!

So what? Alameda and FTX were intrinsically connected from day 1 and Alameda obviously participated in the FTX ICO.

But what happened next was interesting…

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

On-chain data confirms the same as the entire 173 million FTT tokens were then transferred from the Alameda Research address to an FTT ERC-20 deployer controlled by FTX.

6/ Remember, the FTT ICO contract vests automatically.

Had FTX let Alameda implode in May, their collapse would have ensured the subsequent liquidation of all FTT tokens vested in September.

It would have been terrible for FTX, so they had to find a way to avoid this scenario.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

The Alameda bailout eventually proved too costly for FTX to fill, especially in the wake of the Binance feud-led FTT selling spree. This eventually made FTX insolvent forcing it to go under. Cointelegraph reached out to FTX for clarity on the issue but didn’t get a response at press time.

Leave A Comment