As greed indexes stabilize after a buying binge, smart money begins to look for more unique and inherently fruitful opportunities.

Solana, Cardano, CryptoKitties and other highly influential blockchain projects were initially developed during a bear market. Bitcoin (BTC) itself was designed by Satoshi Nakamoto amid the king of bear markets — the 2008 global financial crisis, which became a loud wake-up call about how flawed traditional finance can be.

Bull runs can make almost any asset look attractive and the industry appear less risky than it really is. However, when the tides turn and the charts begin to weaken, even the most fervent optimists may find themselves in a precarious situation where their accustomed decision-making approaches no longer prove effective.

In such cases, adjustments become necessary to successfully navigate downturns. This exploration aims to shed light on potential strategies for adapting to changing market conditions.

The states of bear and bull markets

Volatility indexes and transaction volume metrics aptly capture the cyclical nature of markets of all types, including digital assets. Spikes in volatility often mean that market participants are adjusting to a new state of risk and opportunity, providing great insight into the complex beast that is a market.

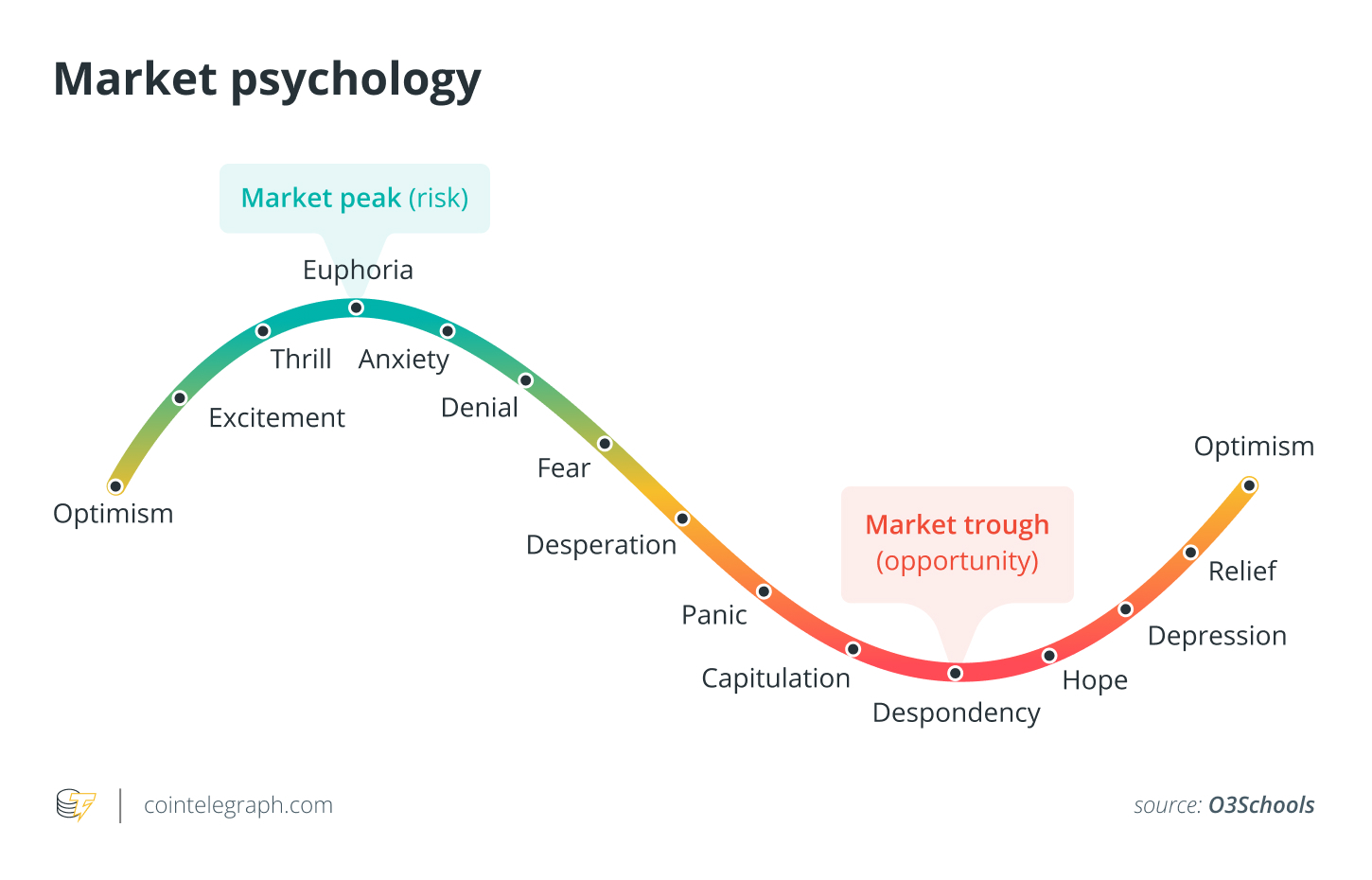

Market psychology attempts to describe it in more familiar, emotional terms such as disbelief, euphoria and denial.

However, these metrics and even market psychology cannot describe the true inner condition of the extended Web3 ecosystem that is at the core of the market.

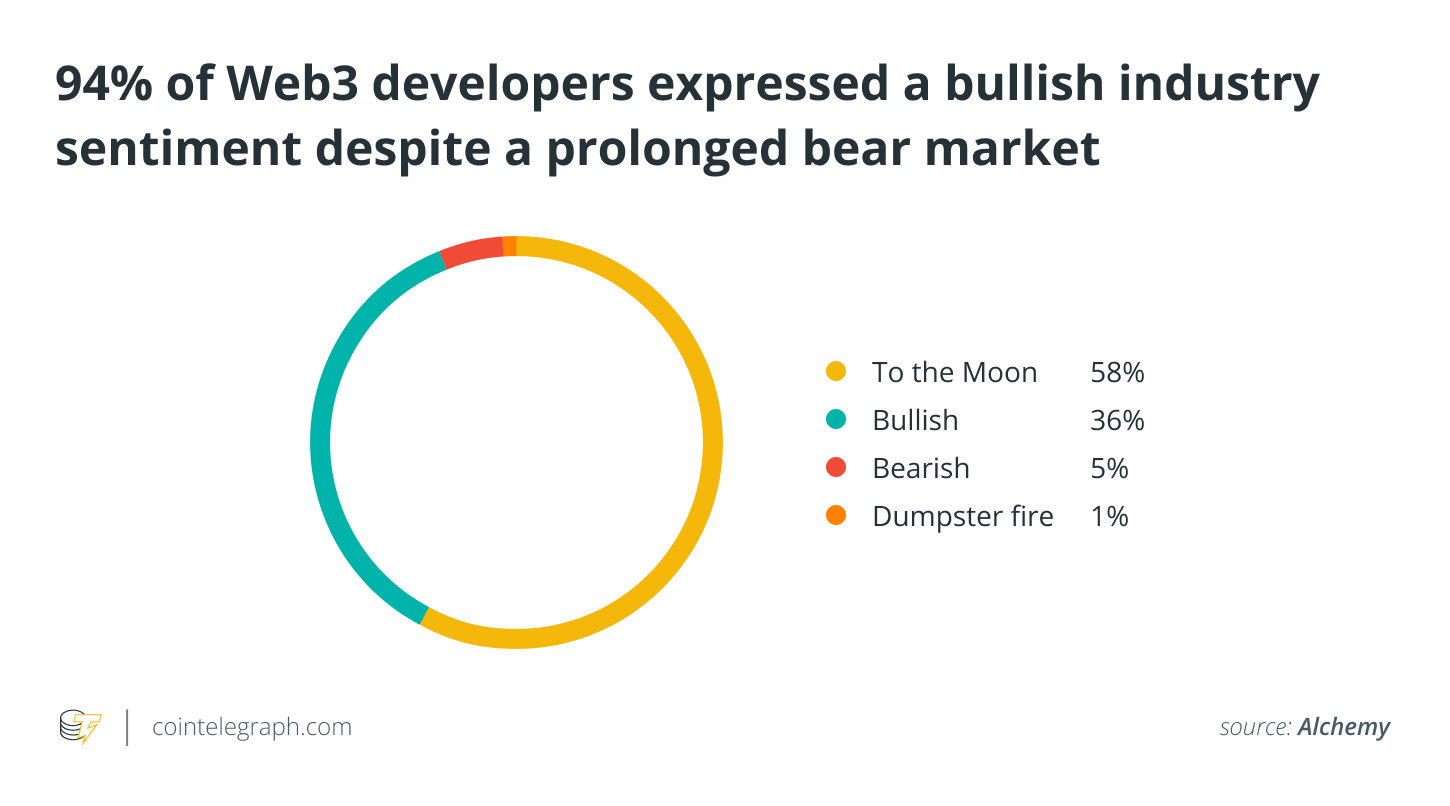

According to Alchemy’s Web3 Development Report, despite a significant drop in consumer crypto confidence in Q4 of 2022, blockchain developer activity experienced a remarkable increase of 453%. The drop coincided with a challenging market environment with no positive outlook. This tells us that when the red rag is put back in the locker and the bulls no longer have a reason to charge, developers continue to build more intensively.

In contrast, amid the ongoing bear market, brilliant minds have pioneered myriad groundbreaking inventions and trends. These include decentralized systems based on zero-knowledge proofs, solutions for seamless Web2-to-Web3 onboarding, liquid staking mechanisms, advanced scaling options for blockchain networks, and even the concept of “forever storage” on-chain.

Relatively new projects that sit at the core of this ecosystem of blockchain subsectors include zkSync, Aztec Network, Lido, Arweave, Sui, Mina Protocol, Metaplex and others, with more emerging by the day.

Venture firms have strong faith In Web3

Even in the face of market challenges, funding for blockchain projects remains resilient, with venture capitalists and angel investors continuing to provide support. This is especially evident in the availability of accelerator programs like the a16z Crypto Startup School, which provide not only guidance but also funding opportunities. Regardless of market conditions, in 2022 alone, crypto projects around the world collectively raised approximately $15 billion from VC investments, showcasing the unwavering determination of developers to build and the enduring vision of venture firms to seize opportunities.

Indeed, the crypto winter seems to be forcing the more resourceful participants in the ecosystem to forge their own paths rather than rely on existing projects that may struggle to recover. This may be due to factors such as outdated technology, weak fundamentals or a lack of sustained community interest. For the average crypto enthusiast, this also opens new doors as industry trends emerge, driven by new inventions or adaptations.

What can be done?

For short-term enthusiasts, a bear market can often resemble a storm at sea, discouraging even the thought of walking along the shore. The risks are high, and it can be costly to dip one’s toes into the market without a vision of the future landscape.

Yet, market cycles exist, arguably even more so in crypto than in traditional finance. So it is possible to take comfort in the fact that the tide will probably turn eventually. Waiting is also costly. That’s why it’s worth spending time reading about new subsectors and the projects within them that are raising the bar on the quality and features of existing technology.

Often, the reward can be much closer than the years-long wait for a bull market, especially when distributed ledger technology and its developers have made it possible for anyone with a wallet to perform complex financial operations like staking, farming, node validation, lending and borrowing — not every gain must be a market gain.

Finding opportunities better with DYOR

However, another problem arises: How does one know about the validity of a found opportunity? This question can drive the enthusiast, even one with great expertise, to a crossroads.

The wider community has used the phrase, “Do your own research,” or DYOR, very generously, and although for a long time, it could hardly be effectively applied to crypto due to too much abstraction, inconclusiveness or plain deceit, the tools are changing for the better.

As people massively migrate from centralized services to decentralized, self-custody ones after the FTX fiasco and alike, they can now access more advanced, usually open-source tools like novel block explorers and analytics and alerts dashboards that bring features such as verifiable historical data in relation to a given project. This allows community members to more rigorously validate opportunities and strong projects to shine brighter.

Conclusion

Since the first glimpses of a stock market in the 17th century, generations of people have tried to use these structures to their advantage. The market has seen perhaps thousands of strategies and approaches for different conditions, but not surprisingly, the market is an unsolved mystery because markets are full of people, and people are full of emotions.

Much like traditional markets — but not quite — the crypto industry seems to show a great drive to innovate during bear markets, while those accustomed to rising prices stand in confusion.

Smart money is keeping up with new research options and understanding of the potential of decentralized tech utility — financial or not. Speculators, as is often the case, pay the price for pure greed and no value added on their part.

Kirthana Devaser is an economist turned financial writer and speaker in the Web3 space. She’s a strong believer in using technology for good and believes that Web3 will drive meaningful change and build a better tomorrow for all. Currently, Kirthana serves as the content and copy manager at  , where she oversees and champions all things content and brand identity across the company.

, where she oversees and champions all things content and brand identity across the company.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment