With crypto gas prices dropping to lows after numerous recent innovations in scaling and interoperability across different chains, we can more vividly imagine a possible shift toward widespread crypto payments.

Crypto payments at scale are currently prevented by regulation, lack of understanding and mass adoption, as well as digital assets being used primarily for investment purposes. For starters, Satoshi Nakamoto’s original concept was steeped in the idea of peer-to-peer digital cash — that’s exactly what appears in the title of his 2008 Bitcoin white paper.

Despite the initial excitement and deep conviction surrounding this pioneering system since its inception, the core idea quietly slipped through the cracks as our focus shifted to cryptocurrency as an investment. The often-expressed nostalgia for the famous white paper became overshadowed by this unintentional deviation.

The remarkable ascent of exchanges, NFT marketplaces and the wide range of financial opportunities enabled by decentralized finance (DeFi) vividly illustrate this phenomenon. Investments are rarely used as mediums of exchange, so the price has been more important than utility in crypto. However, new decentralized systems kept being released, some of which were designed solely for utility, and this has helped change the outlook of cryptocurrency use cases in recent years.

The ups and downs of crypto integration

Some Web3 companies have taken crypto payments for granted and created products like cryptocurrency-based credit cards that can be accepted in many locations, offering novel features as well as more traditional ones like cashback. The importance of crypto payments is the idea of decentralization — other benefits come later.

The introduction of stablecoins backed by fiat currency has shown the potential for traditional finance (TradFi) and DeFi to collaborate more effectively. However, it is important to acknowledge that certain widely-known stablecoin projects such as Terra (LUNA) and even Tether (USDT) have come under scrutiny for questionable operational practices, raising concerns about the effectiveness of this collaboration.

Despite high transaction fees, limited public understanding and regulatory uncertainty, some projects have found ways to integrate crypto into the marketplace for goods and services. The experiments started in the early 2010s with more straightforward, smaller websites such as online book or gift shops, and even web service providers accepting crypto.

A positive landscape for crypto payments

Later, established crypto brands began to work more intensively on payments. Coinbase launched Coinbase Commerce in 2018, a web service that allows businesses and individuals to accept a variety of cryptocurrencies on their websites. Other crypto brands followed suit with their similar products. Today, Bitcoin (BTC) is accepted as payment by major companies, including Microsoft, Intuit, AT&T, Burger King, KFC, McDonald’s, Twitch, Tesla, AMC, Norwegian Airlines and many others.

Source: Unsplash

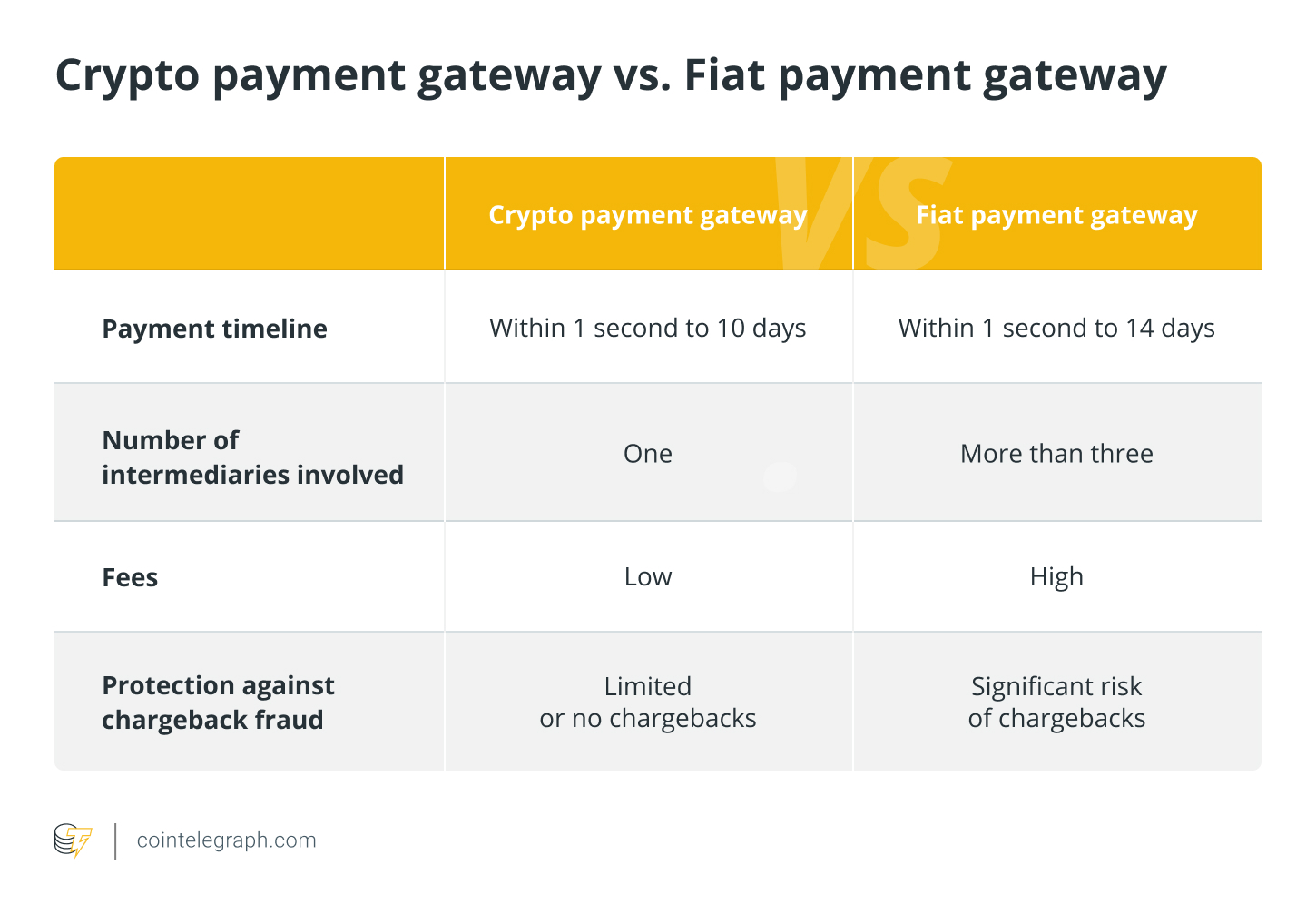

Widespread crypto adoption is closer than one may think when fast food, cars, travel, software and similar necessities can be purchased with digital currency. What has made all of this possible is the rapid advancement of blockchain technology that can interact with the real world, such as payment gateways that bring crypto to e-commerce, interoperable chains and the aforementioned stablecoins for easier pricing of goods.

Payment benefits that come with DLT

Alongside the decentralization of finance, crypto payments bring two major benefits: financial inclusion and efficient cross-border transactions. Financial inclusion refers to the process of financially empowering people who do not have access to banking for a variety of reasons. While centralized crypto companies follow KYC/AML standards, there is still much more room for the unbanked because the barriers to entry are lower.

Cross-border payments are more manageable with crypto because of the very nature of blockchain technology — the network sees no physical borders because there can be no monetary institutions controlling the flow of transactions, and because of its peer-to-peer design. However, there are challenges to making crypto payments available to as many people as fiat payments, including blockchain scalability, asset risk and regulation.

Promoting seamless interaction

Crypto projects are working hard to scale chains using techniques and systems like rollups, sidechains, sharding, SegWit, state channels and more. Today, Ethereum (ETH) handles about 30 transactions per second (TPS), while Bitcoin usually does 7 TPS, and other projects claim to offer more TPS by a large factor.

Solana (SOL), in real-world conditions, processes 5,000 TPS, and BitcoinSV (BSV) has reached over 9,000 TPS, with only a small list of networks offering speeds in a similar range. Comparing blockchain transaction processing speeds to Visa’s 1,700 TPS, the world may soon be ready for unrestricted crypto payments.

Source: Blockdata

Asset risk is still an issue, especially when scaled versions of networks like Ethereum 2.0 raised gas fees alongside TPS, but with a large number of projects working on scalability, the fee-speed equilibrium is closer than ever.

The topic of crypto regulation remains highly dynamic and subject to frequent changes around the world. Startups and developers are keenly aware of this ever-evolving environment and are actively working to build adaptable systems that promote seamless interaction and increased adaptability.

Uncertain crypto regulation spurs developers to innovate

Crypto payments have come a long way since the first Bitcoin transaction — a pizza delivery for 10,000 BTC in 2010. Developers continue to build better crypto payment gateways so that big brands can easily exchange their products for cryptocurrency. New and more secure stablecoins are being released while scaling and interoperability remain core problems whose antidotes are getting better by the day.

The state of crypto regulation is still quite uncertain, so developers can continue to build and then adjust as we see more stability in our laws.

Kirthana Devaser is an economist turned financial writer and speaker in the Web3 space. She is a strong believer in using technology for good and believes that Web3 will drive meaningful change and build a better tomorrow for all. Currently, Kirthana serves as the content and copy manager at  , where she oversees and champions all things content and brand identity across the company.??????

, where she oversees and champions all things content and brand identity across the company.??????

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment