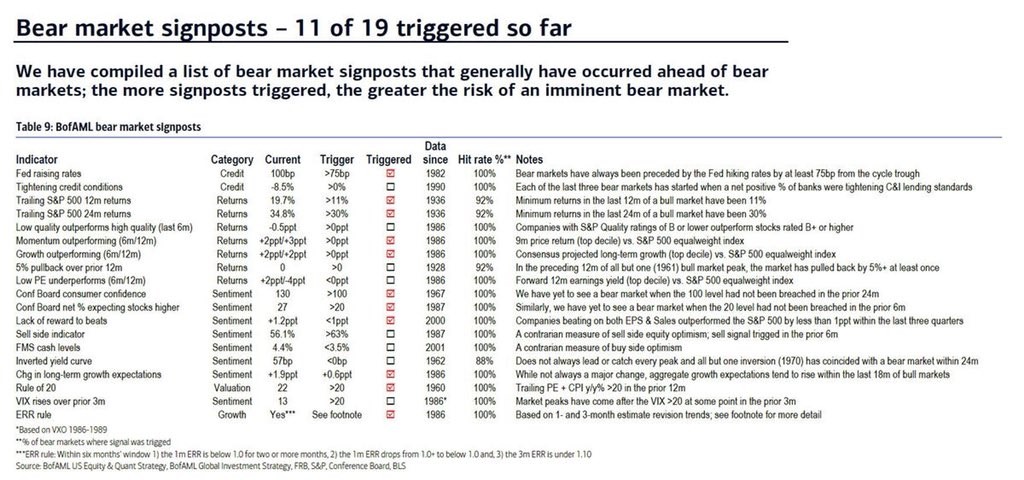

Bear Market Signals Triggered

In previous articles, we’ve reviewed the 30 risks for 2018. Now let’s look at the 19 bear market signposts. As you can see from the image below, 11 of the 19 signposts have been triggered already. The first trigger is the Fed raising rates by more than 75 basis points. This cycle, the Fed has raised rates by 125 basis points, so that has been met. Since 1982, every bear market has been preceded by over 75 basis points of rate hikes. We aren’t at the end of the rate hike cycle yet. The current estimate on the CME Fed Watch tool has the most likely scenario being that the Fed will raise rates twice by December 2018. There’s a 75% chance rates are raised at least twice. The second most common expectation is 3 rate hikes. There’s a 39.5% chance the Fed will meet its goal of at least 3 rate hikes in 2018.

The second signpost is tightening credit conditions. This hasn’t been triggered. The last 3 bear markets have started with the C&I lending standards tightening. C&I lending has been strong this year. It’s slightly off the high set in October. We’d need to see a few bad months is a row before anyone would worry about a recession.

The third signpost is the returns of the S&P 500. In 92% of the periods before bear markets going back to 1936, the trailing 12 month returns in the S&P 500 have been over 11%. With the returns at 19.7%, that trigger has been met. I don’t think of this as a great warning sign because while bear markets have often occurred after excess returns are realized, stocks have rallied many times without a bear market following soon afterwards.

The fourth signpost is about S&P 500 returns again. In 92% of the periods before bear markets, the S&P 500 has returned over 30% in the prior 24 months. My opinion on this point is the same as the last one. Stocks may increase a lot before bear markets, but they also increase a lot during bull markets. This means I think 2 of these indicators so far are bunk.

Leave A Comment