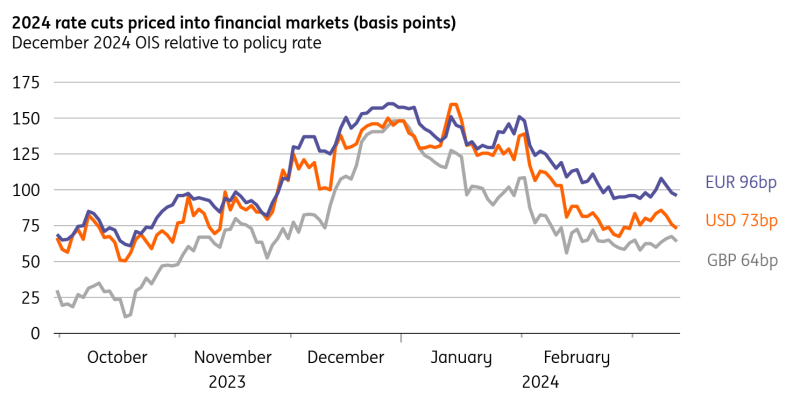

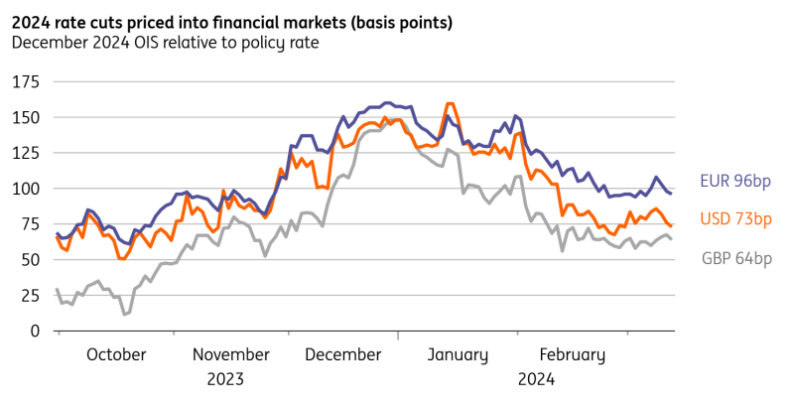

Expect the Bank of England to use Thursday’s decision to reiterate that rates need to stay restrictive for an extended period of time, a signal that it’s too early to contemplate policy easing. We expect the first rate cut to come in August. The Bank’s forward guidance isn’t likely to change – yetThe Bank of England is widely expected to leave rates on hold this month, and we’re not due to get either a press conference or new forecasts either. So the central question for Thursday’s decision is whether policymakers open the door to rate cuts any further, and we think the answer is probably a ‘no’.Remember that back in February, the Bank of England took the first baby step on the road towards cutting interest rates by finally removing its “hiking bias”. It ditched a long-held line in its policy statement that said rates could rise further if inflation showed fresh signs of persistence.With that line gone, that left two key phrases in the statement, which told us that rates needed to “remain restrictive for sufficiently long” and for “an extended period”. Importantly, “restrictive” doesn’t mean that rates can’t be lowered from current levels, and that message was emphasised by Chief Economist Huw Pill in a recent speech.Then again, removing one or both of those pieces of forward guidance would be seen by investors as tantamount to opening the door to an imminent rate cut, something we doubt the Bank will want to do just yet. We therefore expect the March policy statement to look much the same as the one we had back in February. Financial markets have scaled back rate cut expectations since the turn of the year  Macrobond, ING Don’t be surprised if at least one hawk is still voting for a rate hikeThe fact that two out of the nine-strong policy committee were still voting for an immediate rate hike back in February came as something of a surprise. These remaining hawks – Jonathan Haskel and Catherine Mann – have since signalled they need to see more data showing reduced inflation persistence to be comfortable with scrapping their rate hike vote.Since February’s meeting, we’ve had data showing both wage growth and services CPI falling, largely as the Bank had forecast back in February, and importantly we’ve seen further signs that firms’ price and wage expectations for coming months are cooling. Whether or not that’s enough to convince Mann and Haskel to drop their rate hike votes isn’t clear. We wouldn’t be totally surprised if at least one of those committee members still votes for a rate hike this month.At the other end of the spectrum, we saw the first vote for an immediate rate cut back in February. That vote came from Swati Dhingra, who has been a standout dove ever since joining the committee almost two years ago. With little sign that her view is shared by other committee members, we think Dhingra will remain the only policymaker voting for a rate cut at this month’s meeting.In short, another three-way vote split, with the majority of committee members opting for ‘no change’, is a reasonable base case for the March meeting. We saw huge service-sector price rises in 2Q last year

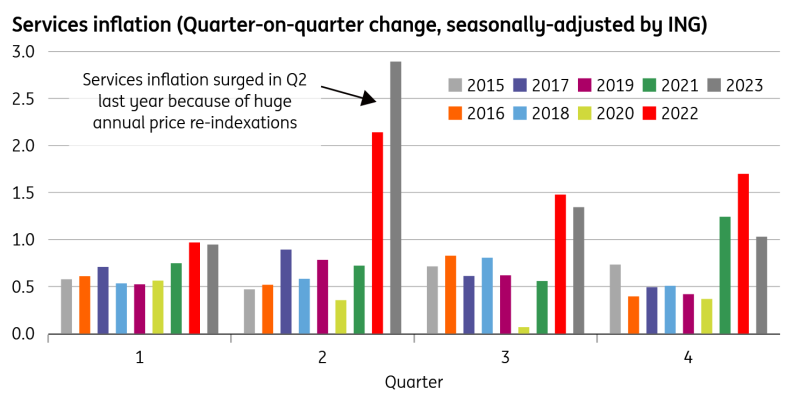

Macrobond, ING Don’t be surprised if at least one hawk is still voting for a rate hikeThe fact that two out of the nine-strong policy committee were still voting for an immediate rate hike back in February came as something of a surprise. These remaining hawks – Jonathan Haskel and Catherine Mann – have since signalled they need to see more data showing reduced inflation persistence to be comfortable with scrapping their rate hike vote.Since February’s meeting, we’ve had data showing both wage growth and services CPI falling, largely as the Bank had forecast back in February, and importantly we’ve seen further signs that firms’ price and wage expectations for coming months are cooling. Whether or not that’s enough to convince Mann and Haskel to drop their rate hike votes isn’t clear. We wouldn’t be totally surprised if at least one of those committee members still votes for a rate hike this month.At the other end of the spectrum, we saw the first vote for an immediate rate cut back in February. That vote came from Swati Dhingra, who has been a standout dove ever since joining the committee almost two years ago. With little sign that her view is shared by other committee members, we think Dhingra will remain the only policymaker voting for a rate cut at this month’s meeting.In short, another three-way vote split, with the majority of committee members opting for ‘no change’, is a reasonable base case for the March meeting. We saw huge service-sector price rises in 2Q last year  Macrobond, ING analysis April and May inflation data crucial to unlocking the first rate cutThe recent messaging from the Bank of England can be boiled down to: the inflation data is slowly improving but wage growth and underlying CPI are still way too high.The second quarter will therefore be highly important. That’s because, at the same time back in 2023, we saw huge increases in services prices, far in excess of what policymakers and most economists had expected. Those were associated with annual index-linked price rises, typically tied to previous rates of headline inflation. That includes things like telecoms bills, for example.Last year’s increases in services inflation through April and May caught people off guard and were a major factor in the BoE’s decision to re-accelerate rate hikes at its June 2023 meeting. In theory, you’d expect this year’s April inflation figures to be less extreme, given that the headline CPI rates that many services prices are tied to have been much lower over recent months.But after last year’s experience, we don’t think the BoE will want to second-guess the numbers. We therefore think June’s meeting will, in practice, be the first ‘live’ meeting. At that point, the committee will have those inflation numbers for April and May, and another couple of wage figures to boot.We suspect the committee will lean towards waiting another few weeks until August’s meeting before cutting rates, at which point it will have a fresh set of forecasts. That’s also what markets are now pricing, though we think the Bank will ultimately deliver a little more easing than investors expect this year. We expect four 25bp rate cuts in total in 2024.More By This Author:The Commodities Feed: IEA Sees Tighter Oil Market FX Daily: The Yen Needs A Dovish Fed More Than A Hawkish BoJPBOC Held Rates Steady In March

Macrobond, ING analysis April and May inflation data crucial to unlocking the first rate cutThe recent messaging from the Bank of England can be boiled down to: the inflation data is slowly improving but wage growth and underlying CPI are still way too high.The second quarter will therefore be highly important. That’s because, at the same time back in 2023, we saw huge increases in services prices, far in excess of what policymakers and most economists had expected. Those were associated with annual index-linked price rises, typically tied to previous rates of headline inflation. That includes things like telecoms bills, for example.Last year’s increases in services inflation through April and May caught people off guard and were a major factor in the BoE’s decision to re-accelerate rate hikes at its June 2023 meeting. In theory, you’d expect this year’s April inflation figures to be less extreme, given that the headline CPI rates that many services prices are tied to have been much lower over recent months.But after last year’s experience, we don’t think the BoE will want to second-guess the numbers. We therefore think June’s meeting will, in practice, be the first ‘live’ meeting. At that point, the committee will have those inflation numbers for April and May, and another couple of wage figures to boot.We suspect the committee will lean towards waiting another few weeks until August’s meeting before cutting rates, at which point it will have a fresh set of forecasts. That’s also what markets are now pricing, though we think the Bank will ultimately deliver a little more easing than investors expect this year. We expect four 25bp rate cuts in total in 2024.More By This Author:The Commodities Feed: IEA Sees Tighter Oil Market FX Daily: The Yen Needs A Dovish Fed More Than A Hawkish BoJPBOC Held Rates Steady In March

Leave A Comment