In 2006, following 35 years of declining U.S. oil production, net monthly imports of crude oil and finished products had climbed to more than 13 million barrels per day (BPD).

What’s happened since is nothing short of amazing. Last week, the Energy Information Administration (EIA) reported that U.S. crude oil production had reached 10.38 million BPD.

This represents an increase of more than 1.2 million BPD in the past year and is more than 5 million BPD higher than March 2006 production levels.

U.S. crude oil demand has fluctuated a bit in recent years but presently stands at just over 20 million BPD, which is about the same level as in 2006.

Given the 10 million BPD difference between U.S. oil demand and U.S. oil production, one might think that the U.S. is still dependent on foreign countries for 50% of our crude oil. But it’s more complicated than that.

U.S. refineries have invested billions of dollars into equipment to process heavy, sour (i.e., contains sulfur compounds) crudes. Most of the new oil production in the U.S. is light and sweet, which isn’t as economically attractive for refiners who have invested in equipment to process the lower grades (which are much cheaper).

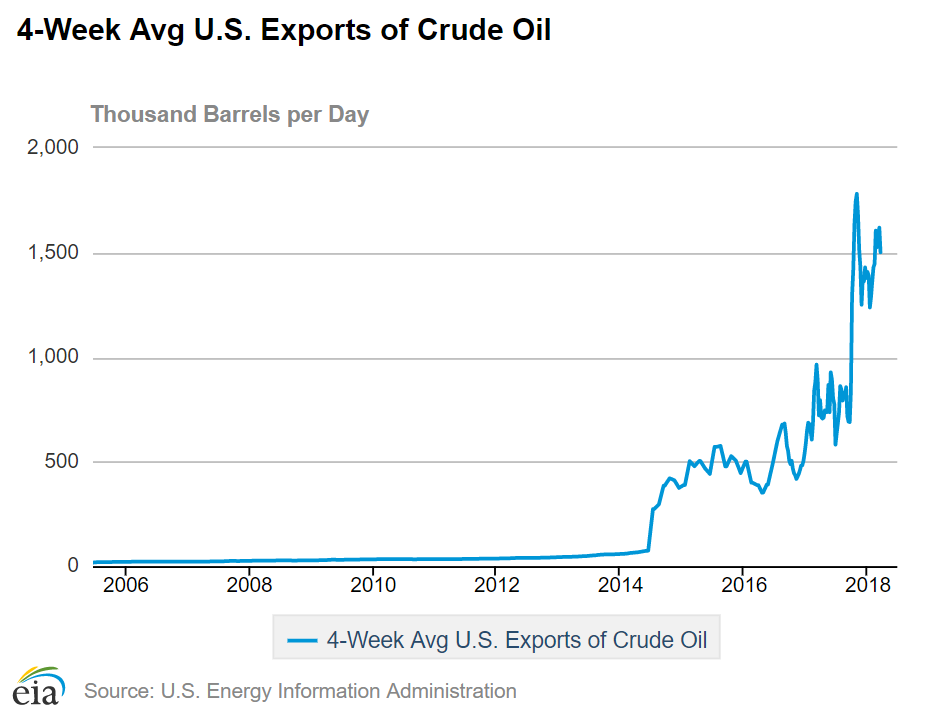

Thus, U.S. oil producers have been exporting an increasing amount of oil, while U.S. refiners import the cheaper heavy grades. In just the past four years, U.S. crude oil exports have jumped from nearly nothing to more than 1.5 million BPD:

U.S. crude oil exports.

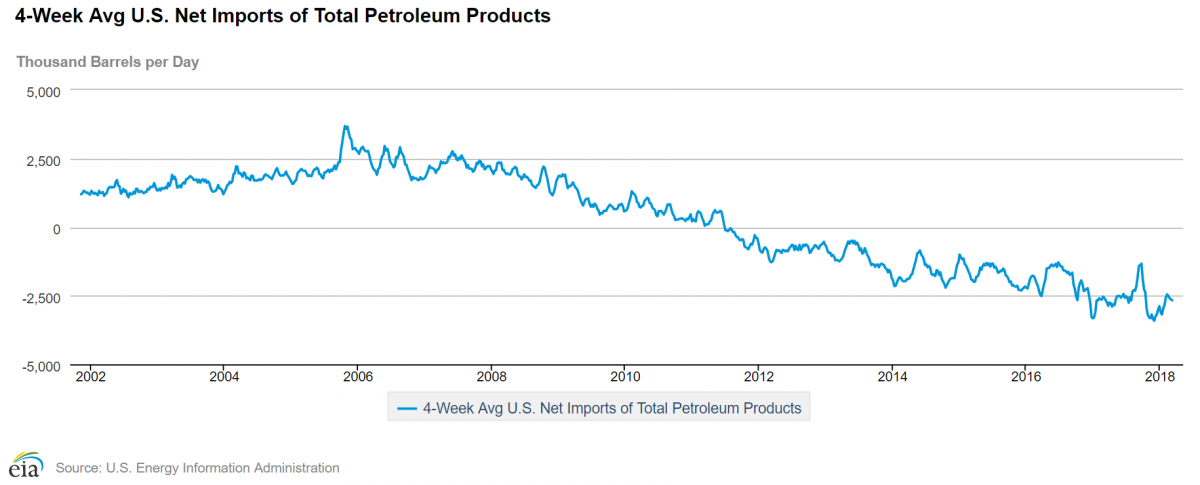

But the U.S. also exports finished products like gasoline and diesel. In fact, a growing fraction of the oil being consumed in the U.S. is simply being refined and exported. In 2011, the U.S. became a net exporter of finished products (e.g., diesel, gasoline, etc.) for the first time since 1949. Finished product exports have continued to grow since:

Net finished petroleum product exports.

Note that this graphic reflects the difference between the finished products we import and those we export.

Leave A Comment