The Chinese often operate in nuanced ways. Their central bank policies for influencing interest rates, for example, often use methods to influence interest rates that are not as clear as those used in the developed world. Last week’s People’s Bank of China (PBOC) rate hike, which has not resulted in tighter monetary conditions, is but one example. “Investors should be cautious about interpreting interest rate changes in China using the same framework they apply to central bank actions elsewhere,” Capital Economics noted in a December 21 report.

PBOC doesn’t use REPO rate as quantitative measures target goals

The PBOC has not made a full transition towards targeting intrabank rates as is commonly done among major economy central banks. Instead of taking these actions with the goal to influence borrowing, they publish benchmark rates and use an explicit quantitative tool to influence how much interest is charged to borrowers or paid on bank deposits.

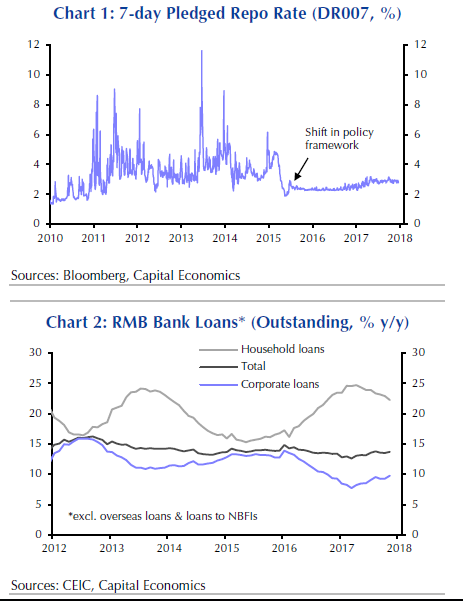

The PBOC set a target for monetary growth, making use of reserve requirements and quotas for bank lending, including broad measures of monetary growth.

“Because the quantity of money, rather than its price, was the focus, interbank rates were left to fluctuate wildly in response to swings in liquidity demand,” Julian Evans-Pritchard, Capital Economics senior China economist, and Mark Williams, the chief Asia economist, noted in a December 21 “Refresher on China’s monetary policy framework.”

With Chinese banks becoming a lessoned factor in issuing new credit, the broader quantitative controls were the move to better influence interest rates as opposed to interbank tightening measures.

PBOC leaves market participants guessing, but watch actions not words

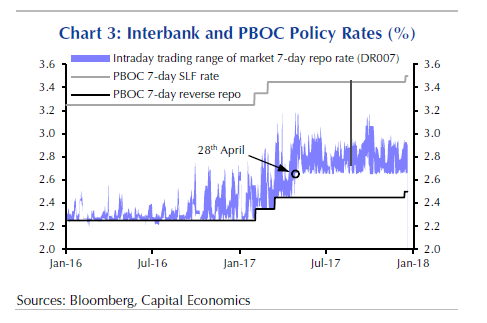

In 2015, while experimenting with the 7-day repo rate, a “peculiarity of the Chinese system” began to show.

In most regions, the interest rate charged by the central bank to the market sets a ceiling for market rates. Because the PBOC doesn’t provide funds through its reverse repo operations on demand, most transactions take place above the reverse repo rate. This is coupled with communication that often leaves market participants guessing:

Leave A Comment