Kazatomprom produces about a fifth of the global uranium supply. The Kazakh company revealed in a financial report this AM that its production target for next year will be 17% lower to the range of 25,000 to 26,500 tons of uranium.

Kazatomprom produces about a fifth of the global uranium supply. The Kazakh company revealed in a financial report this AM that its production target for next year will be 17% lower to the range of 25,000 to 26,500 tons of uranium.

Kazatomprom has previously warned that if limited access to sulphuric acid continues throughout this year, and should the Company not succeed in catching up with the construction works schedule at the newly developed deposits in 2024, Kazatomprom’s 2025 production plan may also be affected. The Company is now adjusting its initial intentions for 2025 production volumes of 30,500 – 31,500 tU (100% basis). Kazatomprom’s 2025 production is now expected to be between 25,000 and 26,500 tU (100% basis), an approximately 12% growth compared to its 2024 guidance.

A significant portion of the adjusted 2025 production is attributed to JV Budenovskoye LLP’s production delays as specified above. JV Budenovskoye LLP’s 2025 production is expected at 1,300 tU instead of the previously approved 4,000 tU (more than a 65% decrease).

Meirzhan Yussupov, chief executive of Kazatomprom, wrote in a statement that “the uncertainty around the sulphuric acid supplies for 2025 needs and delays in the construction works at the newly developed deposits resulted in a need to re-evaluate our 2025 plans”.Here’s a quick take from Goldman’s James McGeoch on the world’s largest uranium producer cutting next year’s production forecast:

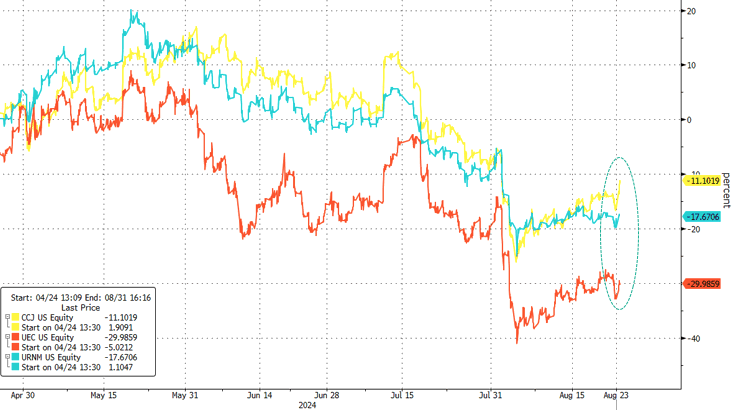

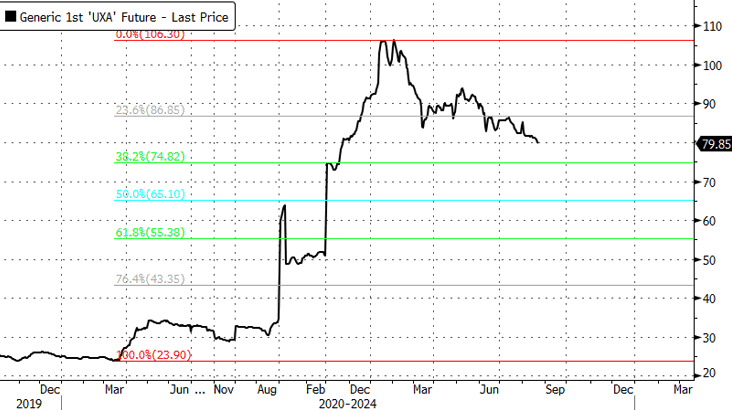

FY24 22,500 – 23,500 guidance (this is +1kt v prev guide). Revision lower to 2025 guidance by 18% at 25k-26.5kt (prev 30.5kt to 31.5kt): “the uncertainty around the sulphuric acid supplies for 2025 needs and delays in the construction works at the newly developed deposits resulted in a need to re-evaluate our 2025 plans”…so i take a look at this holistically, we know this trade is on, its just that everyone got burnt. When do you come into it? now may be good if you can handle the liquidity issues and you feel like you want to lean into a pretty narrow vein of opportunity. Prices are back at c.$80 having traded last year to c.$105lb. The perspective is 2025 Production guidance cut from 82mm lbs to 65-68.9mm lbs – a 14-17mm lb cut on a 150mm global industry supply number, its a big chunk of change. Inventories -30% even with lower 2024 prodn than initially planned and lower 2025 guidance. If they presold some of 2025/26 prodn – they will have to go into spot mkt to replace. If you follow it your as bullish as you have ever been, our job is to get the man on the street back in and that means you have to compete with Copper which is far more investible. Happy to discuss anytime.

“This is a structural problem — they cannot ramp up,” Nick Lawson, chief executive of Ocean Wall, an investment firm, said, as quoted by Financial Times. He added, “It won’t just be the West saying this is an issue for us; it will also be Russia and China saying it’s a problem for our new nuclear power plants.”Analysts at Canaccord Genuity forecast Kazatomprom’s production will be around 23,000 tons in 2025, adding that next year’s theme in the uranium market will be “tight.” Uranium prices have surged in recent years. Wall Street finally figured out (read here) that nuclear power would be the cleanest and most reliable energy source for AI data centers (read: here) and other electrification trends, such as EVs and reshoring efforts. A tight uranium supply theme rolling into 2025 could pressure prices higher. Kazatomprom’s downgrade “should be a cause for concern for Western utilities. The geopolitical developments and writing on the wall has been the Russians getting closer to the Kazakhs,” said Per Jander, director at WMC Energy, a commodity trading merchant.More By This Author:Powell Pivot Sparks Buying Panic In Bonds, Bitcoin, & Bullion As Dollar Dumps To 2024 Lows

Kazatomprom’s downgrade “should be a cause for concern for Western utilities. The geopolitical developments and writing on the wall has been the Russians getting closer to the Kazakhs,” said Per Jander, director at WMC Energy, a commodity trading merchant.More By This Author:Powell Pivot Sparks Buying Panic In Bonds, Bitcoin, & Bullion As Dollar Dumps To 2024 Lows

Money-Market Funds And Bank Deposits See Huge Inflows As Stocks Rebounded

Stocks & Bonds Slammed Ahead Of J-Hole As FedSpeak Slows Rate-Cut Euphoria

Leave A Comment