Image Source: DepositPhotos

Image Source: DepositPhotos

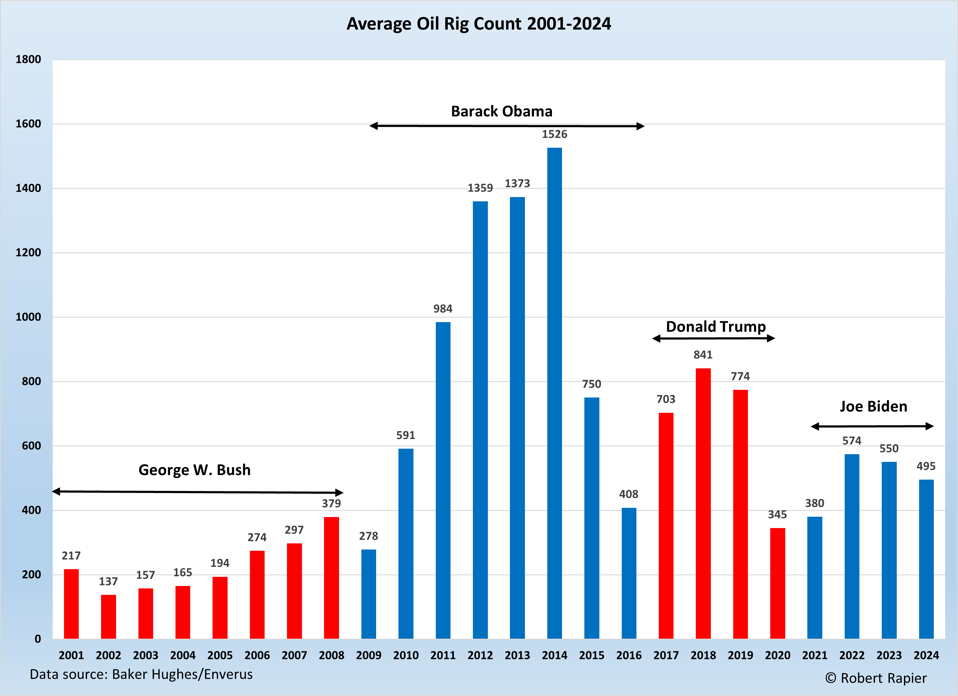

One of the most popular articles I have ever written is Average Gasoline Prices Under The Past Four Presidents. It has been used by people across the political spectrum to support different points.Republicans often cite it to show that gasoline prices were lower under Donald Trump compared to Barack Obama or Joe Biden. On the other hand, Democrats point out that Trump inherited low prices from Obama, and that those prices rose for two consecutive years under Trump.Both points are valid, but the broader context discussed in the article is often overlooked. The graphic in that piece acts like a Rorschach test, where people often see only what supports their viewpoint.I anticipate a similar reaction to today’s article, which delves into claims about which presidents were most favorable for oil drilling. Using data from the Baker Hughes Rig Count, I created a graphic showing the average number of rigs drilling for oil each year under the past four presidents. Republican presidents are marked in red, and Democrats in blue.

Average Oil Rig Count 2001-2024. Robert Rapier

Average Oil Rig Count 2001-2024. Robert Rapier

The data alone might lead some to the misleading conclusion that President George W. Bush, often seen as pro-oil, was bad for drilling. Meanwhile, President Obama, who wasn’t exactly known as a friend to the oil industry, was by far the best of these presidents when it came to drilling. However, this data needs context.If you were to overlay oil prices on this data, it would show that higher oil prices typically lead to increased drilling. However, the story is not just about prices but also about technological advancements.Today, oil companies can extract far more oil per rig than they could in 2001. Even though the rig count declined sharply after its peak under Obama, U.S. oil production continued to set records year after year. Last year saw the highest oil production in U.S. history, and we are on pace to top that this year.In the decade before Bush became president, oil prices had averaged about $20 per barrel. Oil production in the U.S. had been declining for 30 years. That was the environment for oil companies in 2001.The rig count during President George W. Bush’s tenure was influenced by factors like steady growth in Chinese oil demand and a slow response from Saudi Arabia to increase production, leading to fears of shortages and eventually a bubble in oil prices.That bubble burst in 2008 with a recession, causing a drop in global oil demand. As a result, drilling activity sharply declined during President Obama’s first year, though this drop had more to do with the recession and oil price crash than with a change in administration.During Obama’s presidency, oil prices initially rose as the economy recovered, driven by the same factors that had pushed prices up under Bush. However, technological innovations like hydraulic fracturing and horizontal drilling began reversing the long decline in U.S. oil production and would ultimately force OPEC to react.Oil prices averaged close to $100 per barrel from 2011 to 2014, leading to record drilling activity. But Saudi Arabia initiated a price war in late 2014, aiming to reclaim market share lost to U.S. shale oil.That price war — which I called OPEC’s Trillion Dollar Miscalculation — ultimately crashed oil prices to below $30 per barrel. Gasoline prices also sharply fell during that period. In response to low prices, the rig count plummeted in Obama’s last two years.Under President Trump, oil prices rose during his first two years, reaching $65 per barrel in 2018 (source). The rig count followed oil prices higher. However, the COVID-19 pandemic in 2020 crushed oil prices globally, causing the rig count to collapse to its lowest level since 2009.The price of oil would recover sharply in 2021, and then in 2022, it would surge to above $100 for the first time since 2014. Several factors drove oil prices higher. One, some U.S. production was lost during the pandemic crash. Some producers went bankrupt, and others permanently shut in marginal production. Second, OPEC — at the request of President Trump — sharply cut production in 2020.When the economy began to strongly recover, loss of production from U.S. producers and lower production from OPEC helped cause prices to surge. Russia’s invasion of Ukraine was the final catalyst that drove oil prices back over $100.Although the rig count has rebounded under President Biden from the pandemic lows, it remains lower than in previous years. Biden’s administration has averaged 500 rigs, compared to 666 under Trump and 909 under Obama. Despite this, average oil production under Biden has been 12.2 million barrels per day (BPD), compared to 11.0 million BPD under Trump and 7.2 million BPD under Obama.This discrepancy highlights that the rig count is a poor short-term predictor of oil production, as it reflects a complex interplay of oil prices, technological advancements, and evolving strategies by oil companies focused on fiscal discipline.In conclusion, interpreting rig count data without considering the broader context can lead to misleading conclusions. Rig count data is part of a larger puzzle that includes oil prices, technological development, and a shift in strategies by oil companies determined to demonstrate more fiscal discipline.Understanding these factors is crucial for accurately assessing the impact of different presidential administrations on the oil industry.More By This Author:The Reality of the Energy Transition

Why The U.S. Is Losing Ground In The Critical Global Lithium Market

Renewable Energy Reaches New Heights

Leave A Comment