Image Source: Pexels

Image Source: Pexels

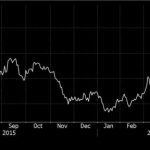

Tentative improvements show that monetary easing in the Eurozone is having an effect but that more needs to be done for investment to undergo a more meaningful recovery in 2025.Bank lending in the Eurozone showed some improvement in September as non-financial corporates saw a strong increase in month-on-month lending, and lending to households continued its cautious accelerating trend. Still, this kind of monthly data is volatile and annual growth rates remain very subdued at 1.1 and 0.7% growth, respectively, for corporates and households. While this is increasing, it is only comparable to levels seen in 2015-16. We were seeing faster growth in bank lending before 2023. Needless to say, this is not yet translating into a buoyant investment rebound.The European Central Bank recently released its bank lending survey, which showed some tentative improvements in the lending environment. Banks did not tighten credit standards for the first time in over two years, and demand for borrowing is cautiously improving, especially for households. This indicates that the start of the cutting cycle is starting to show some early signs of impact on the early parts of the lending channel.The ECB has taken note of the weak recovery in bank lending. At the moment, it looks like the ECB is rushing towards a neutral rate as concerns about economic growth have taken over from inflation fighting. With bank lending muted but showing cautious signs of improvement, the ECB is likely to take today’s data release as encouragement that taking their foot off the monetary brake further will have an impact on the prospect of improving economic activity.More By This Author:FX Daily: The Dollar’s Rally May Only Be On Pause Bank Of Japan Expected To Hold Steady At October Meeting Political Gridlock And Post-Eelection Fed Cuts

Leave A Comment