In this past weekend’s newsletter, I discussed the potential for an end to the current bull market cycle. It was not surprising that even before the “digital ink was dry,” I received emails and comments questioning the premise.

It is certainly not surprising that after one of the longest cyclical bull markets in history that individuals are ebullient about the long-term prospects of investing. The ongoing interventions by global Central Banks have led to T.T.I.D. (This Time Is Different) and T.I.N.A. (There Is No Alternative) which has become a pervasive, and “Pavlovian,” investor mindset. But therein lies the real story.

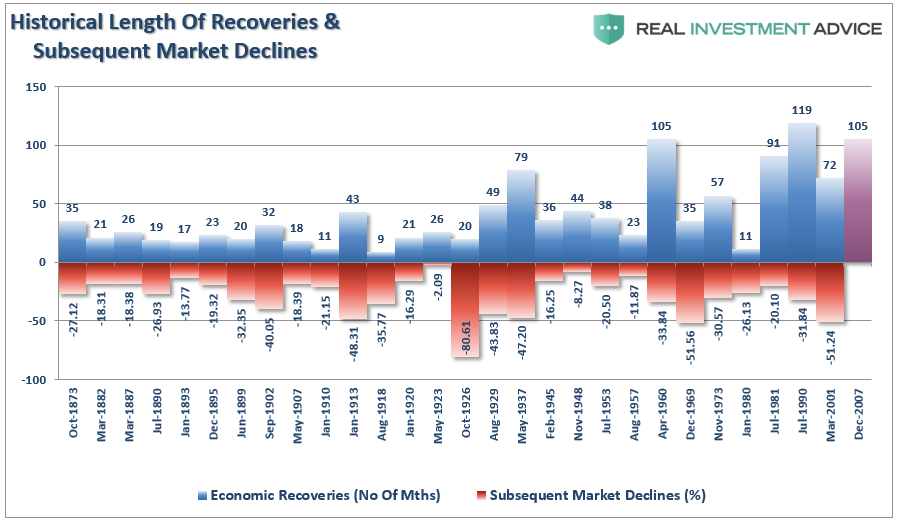

The chart below shows every economic expansion going back to 1871 and the subsequent market decline.

This chart should make one point very clear – this cycle will end.

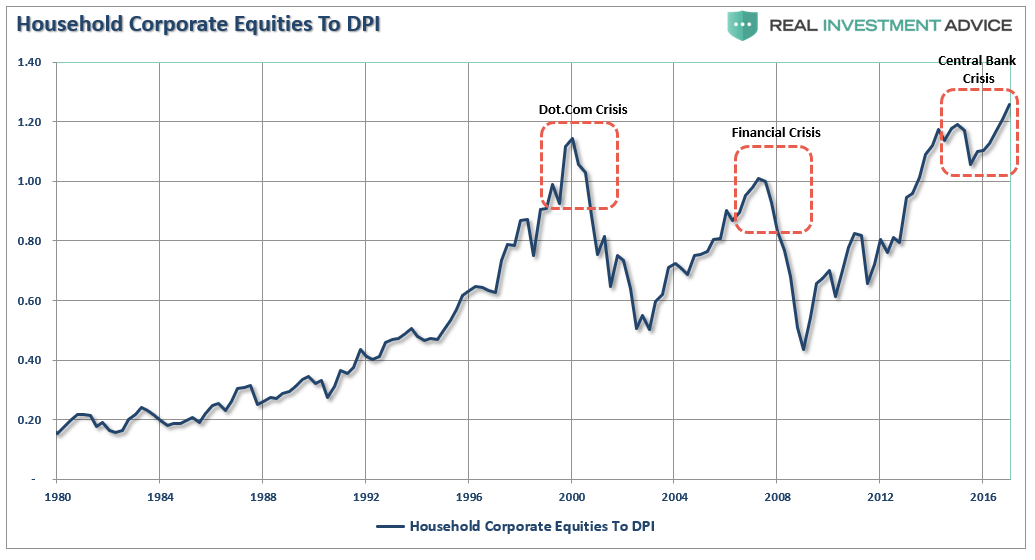

However, for now, there is little doubt the bullish bias exists as individuals continue to hold historically high levels of equity and leverage, chasing yield in the riskiest of areas, and maintaining relatively low levels of cash as shown in the charts below.

There are only a few people, besides me, that discuss the probabilities of lower returns over the next decade. But let’s do some basic math.

First, the general consensus is that stocks will return:

Plug in the math and we get the following scenarios:

Here is the problem with the math.

First, this assumes that stocks will compound at some rate, every year, going forward. This is a common mistake that is made in return analysis. Equities do not compound at a stagnant rate of growth but rather experience a rather high degree of volatility over time.

The ‘power of compounding’ ONLY WORKS when you do not lose money. As shown, after three straight years of 10% returns, a drawdown of just 10% cuts the average annual compound growth rate by 50%. Furthermore, it then requires a 30% return to regain the average rate of return required. In reality, chasing returns is much less important to your long-term investment success than most believe.

Leave A Comment