Spanish stocks and the euro fell, while Spanish government bond yields hit their highest levels in over a month after Catalan secessionists delivered an unexpected blow to the government of Spanish PM Rajoy by winning the Catalan regional election. Meanwhile across the Atlantic, U.S. equity futures and the dollar rose on the last trading session before the Christmas holiday. The MSCI index of world stocks was flat.

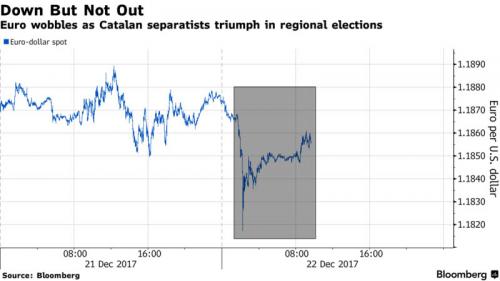

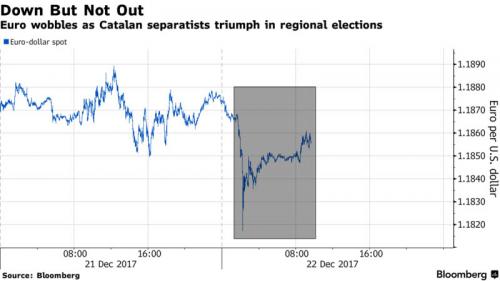

Europe’s Stoxx 600 Index traded sideways as Spain’s Ibex 35 underperformed, dropping as much as 1.6%. Spanish stocks dominated Europe’s biggest fallers, confirming analyst expectations that any shake-out from the Catalonia vote would be mostly confined to Spain. Spain’s bonds also fell along with peripheral European government debt, though bunds were little changed after a selloff this week drove yields to five-week highs. For those who missed it, Catalan separatist parties triumphed in regional elections, outperforming some polls and reigniting Spain’s political trauma. While the Euro has stabilized since, it suffered a mini flash crash in the illiquid aftermath of the Catalan election news, momentarily dipping to $1.1817 before trimming losses to last stand at $1.1853, down 0.2 percent.

“This is Groundhog Day, we have been here,” said Christopher Peel, chief investment officer at Tavistock Wealth. “I just don’t think the Spanish government can do anything other than come to the table now.” He added that thin liquidity due to the holidays could be accentuating what he called a kneejerk reaction on the IBEX. “Likely there’s some hedge funds leaning on it, but in terms of long-only money I don’t think there will be much movement now.”

The result also battered Spanish stocks, with Spain’s IBEX falling as much as 1.1% as European bourses opened. Financial stocks were the biggest drag on stock indices across the region, with the eurozone banks index falling 0.8 percent. Investor concerns about the country were a distraction from economic data, with reports on consumer spending, wholesale prices and gross domestic product from France and the Netherlands underscoring the region’s health. Elsewhere in Europe, the chaos was contained as Germany’s DAX edged down 0.1 percent, in line with France’s CAC 40.

Putting the move in context, Spanish stocks were Europe’s best-performing benchmark for much of the year, before October’s independence referendum sent the IBEX tumbling. It was last 9 percent down from its May peak.

Earlier, equities in Asia closed the week largely in the green, with Japan’s Topix Index reaching its highest level since 1991. Asia rejoiced to the news that Congress passed the stop-gap measure which would avert a shutdown and keep the government funded through to January 19th. Australia’s ASX 200 (+0.2%) was higher as energy stocks tracked the outperformance seen in their US counterparts, while Nikkei 225 (+0.2%) was tepid as flows into the JPY restricted upside for equities. Elsewhere, Hang Seng (+0.7%) was positive and Shanghai Comp. (+0.1%) traded somewhat indecisive after the PBoC refrained from open market operations, which still resulted to a net liquidity injection of CNY 200bln for the week. Finally, 10yr JGBs were sideways amid a lack of drivers and an indecisive risk tone in Japan, while an uneventful enhanced liquidity auction for 10yr-30yr JGBs also kept price action tame. PBoC refrained from open markets operations today, for a weekly net injection of CNY 200bln vs. last week’s CNY

Although Treasuries stabilized, they were set for the biggest weekly loss since September as investors contemplate prospects for continued growth and reduced central bank stimulus.

In addition to the fireworks in Spain, in the US, the House voted 231 vs.188 and Senate voted 66 vs. 32 to pass the stop-gap funding bill to keep the government funded through to January 19th. Elsewhere, US Federal Judge dismissed a lawsuit against President Trump regarding foreign payments to Trump-owned businesses, US President Trump’s Deputy Chief of Staff Rick Dearborn and White House Economic Advisor Katz are said to resign, according to reports. Additionally, CNBC reported that Larry Lindsey is being considered for role of Fed Vice Chair and he is also said to be interested in exploring the job.

* * *

The Bloomberg Dollar Spot Index edged higher and Treasuries steadied before a spate of U.S. economic data including the Fed’s preferred measure of inflation. The euro slipped after Spain’s pro-independence parties prevailed in the Catalan vote, but the currency was still on track for its first weekly advance against the greenback since November.

“As liquidity on the markets is likely to be quite thin already, surprisingly strong data might provide some decent support for USD into the year-end,” write analysts at Commerzbank, including Antje Praefcke, referring to Friday’s U.S. inflation data. “Inflation has remained weak despite a strengthening economy and labor market so until this puzzle is solved for the market, strong USD appreciation is unlikely.”

The DXY continues to languish below 93.500 after another brief knee-jerk above as Congress approved a further stop-gap funding extension. In truth, very little deviation in Usd/major pairs with the Index confined to a tight 93.555-340 range, though again the downside looks more attractive unless Friday’s data gives the Greenback a boost (PCE and durables the picks of a packed agenda). For GBP, UK GDP data has given Sterling some additional impetus with Q3 y/y growth was upgraded to 1.7% from 1.5% in the final release).

* * *

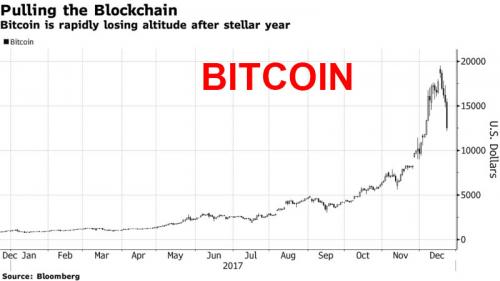

Just as dramatic as the Spanish fireworks was the overnight crash in Bitcoin and the cryptocurrency space. Bitcoin fell as much as 21%, briefly sliding below $13,000 on Friday, last trading at $13,885. Bitcoin, which was at about $1,000 at the start of the year, had climbed to a record high of $19,666 on Sunday. But it has fallen each day since then, with losses accelerating on Friday. It fell to as low as $12,560 on Bitstamp. At 0700 ET it was trading at around $14,000 and was heading for its worst day in more than three months. The plunge resulted in bitcoin’s worst week since April 2013, down about a third.

Other cryptocurrencies also tumbled, with bitcoin cash crashing 31 percent and Eethereum losing 20 percent over the past 24 hours, according to coinmarketcap.com.

As Bloomberg notes, the losses represent a major test for the cryptocurrency industry and the blockchain technology that underpins it, which have rapidly entered the mainstream in recent weeks. Bears cast doubt on the value of the virtual assets, with UBS Group AG this week calling bitcoin the “biggest speculative bubble in history.” Bulls argue the technology is a game changer for the world of investment and finance. Both will be closely watching the outcome of the current selloff.

Leave A Comment