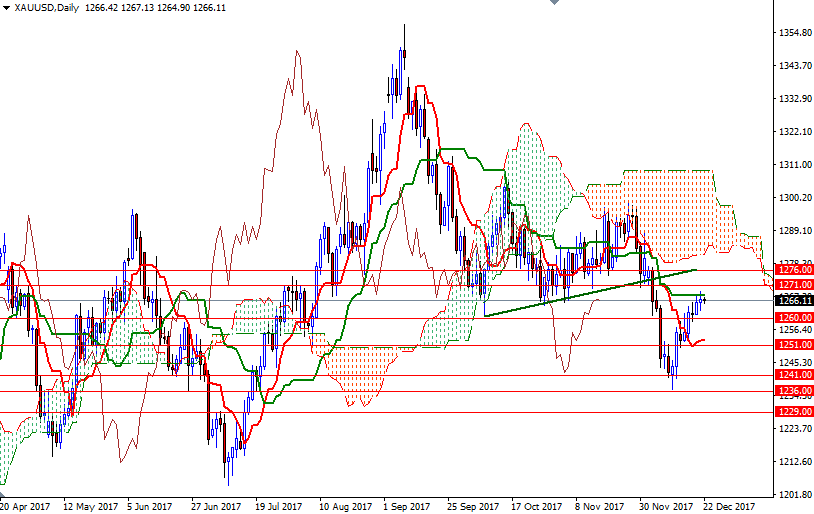

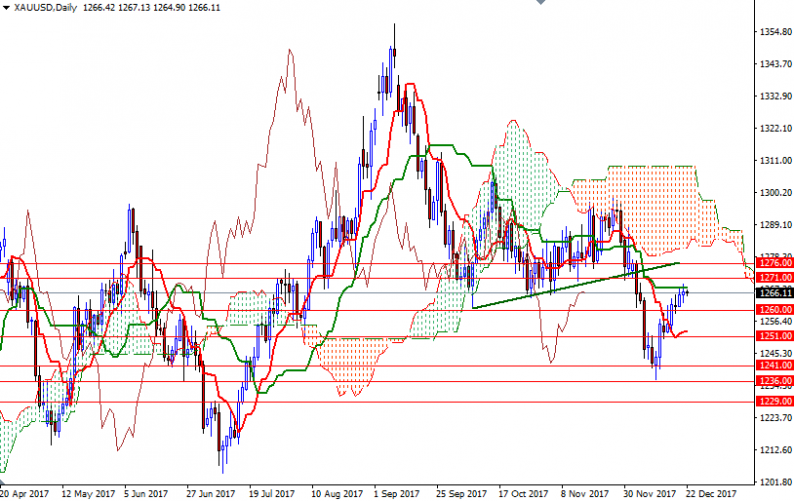

Gold prices ended Thursday slightly higher after a quiet session. XAU/USD tested the resistance in the $1271-$1269 area but it was unable to break through. As a result, the market retreated to the $1265 level. In economic news, the Commerce Department reported that gross domestic product expanded at a 3.2% annual rate in the third quarter. A separate report from the Labor Department showed the number of people filing new claims for unemployment benefits jumped by 20K to 245K.

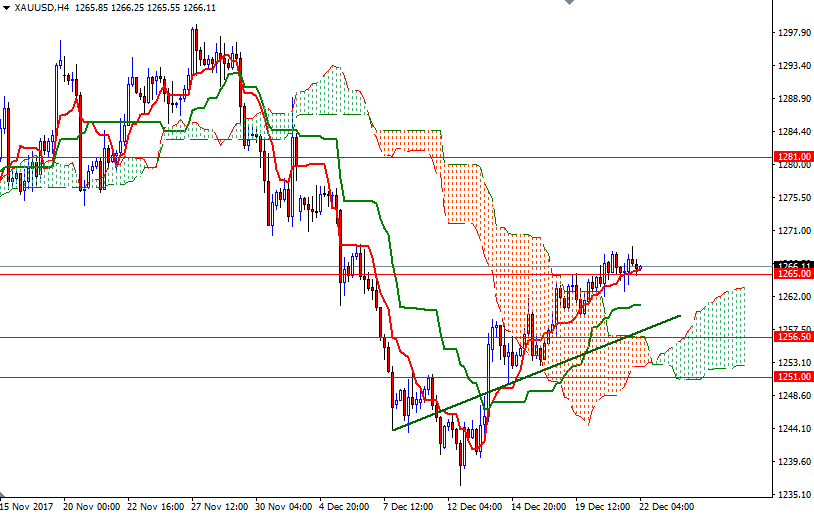

Trading was lighter than usual yesterday as market participants were reluctant to open new positions ahead of the upcoming Christmas holiday. The market continues to trade above the Ichimoku clouds on the 4-hourly and the hourly charts, but the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are flat. The absence of a strong momentum suggests that prices will be range bound for a period of time.

If the market convincingly penetrates 1271/69, we may see an extension towards 1276/5. A daily close above 1276 could foreshadow a move to 1281. To the downside, the initial support sits in 1263/3. If this support is broken, the 1260/59 area will be the next target.

Leave A Comment