You’ve got to love Kuroda.

On Thursday, after leaving the Bank of Japan’s lunatic monetary policy unchanged as expected, the world’s foremost authority on the type of currency debasement that’s effectively making cryptocurrency bulls’ argument for them delivered his assessment of Bitcoin at the post-meeting presser. And this being Kuroda, it did not disappoint when it comes to comedic value.

“The rise [in bitcoin] is undoubtedly abnormal,” he said during the media conference, adding that “Bitcoin is used not as a means of settlement but rather as pure speculation.”

But that was hardly the punchline. Rather, the punchline came when the famously jovial BoJ Governor Kuroda-splained why he thinks Bitcoin might be out of control. To wit, from the same press conference:

Bitcoin’s price looks abnormally high if you graph it.

Yes, it does. Of course, so does the BoJ’s balance sheet. [Note: for some members of the crypto community who aren’t familiar with Kuroda, it might not be immediately apparent why that is so funny, so in order to appreciate it, just read this]

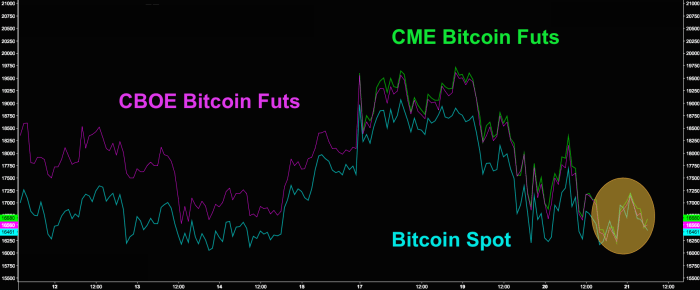

Meanwhile, remember how Bitcoin futs were persistently trading at a premium to spot after the Cboe launch? And remember how that began to disappear leading up to the launch of the CME product? Yeah well now, futures are trading at a discount to spot.

That’s not great. “Most directly, this implies that those trading futures believe bitcoin will settle at a lower price in January relative to where it’s trading right now,” Bloomberg’s Mark Cudmore writes on Thursday, before noting that “it should be emphasized that this is unlikely to be a perfect indicator in isolation since the futures are cash-settled and therefore not a foolproof vehicle for those attempting a bear-attack on bitcoin.”

Throw in the readily apparent bid for bitcoin cash and the fact that thanks to the holiday shopping season, retail investors are likely to be a bit short on disposable income available for speculating in cryptocurrencies and this is a bearish setup.

Leave A Comment