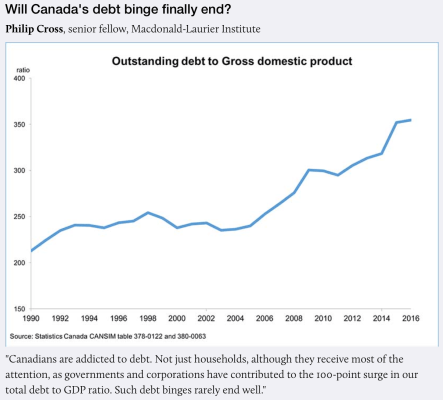

Funds to sustain Canadian consumer spending over the past several years, have come largely from credit–not income or savings. Thus, consumer debt has driven nearly all of the economy’s growth since 2014 and caused many observers to quite rationally ask, when will Canada hit the end of this debt binge? (Debt to GDP shown here since 1990.)

As interest rates fell since 2007 and homeownership rates have risen to a remarkable 70%, realty prices have risen faster than historic norms, and the formula for spending has been simple: outspend income, rack up debt, consolidate into a bigger home loan. Repeat. Over, and over, again.

As mortgage rates and regulations have tightened over the past couple of years, some homeowners have become private lenders themselves, borrowing funds on their own Home Equity Line of Credit (HELCO) at 3% and loaning it to a subprime borrower at 8-12% with interest-only payments. Brilliant, right?So long as prices continue to rise, the subprime borrower can grow enough equity in a year or so to roll the private HELCO advance onto their own mortgage and pay back the prime borrower. What could ever go wrong?

Well as the US saw in the 2005-08 build up to its housing crisis, rolling over into an endless stream of new loans only works so long as prices never stop going up. When they do, and when–perish the thought–prices move lower, then all hell breaks lose in the loan daisy chain. We are getting to that point now. The pay-down, write off phase is set to be larger and longer this cycle than we have seen in several decades, and no one should be surprised. See: Home Equity Lines of Credit spur private lending.

As of 2016, HELOC balances sit at $211 billion, a 500% increase since the year 2000. While also pushing Canadian household debt to incomes to record highs of 168%.

Leave A Comment