A cryptocurrency exchange in South Korea collapsed on Tuesday after it suffered a second cyberattack in eight months and lost a large amount of its digital-currency reserves. This spooked Asian investors who sold Bitcoin (and other cryptos).

As The Wall Street Journal reports, Yapian, the company that operates a Seoul-based exchange called Youbit, suspended digital-currency trading and filed for bankruptcy after its systems were hacked in the predawn hours of Tuesday. The exchange trades 10 virtual currencies including bitcoin and ethereum.

Yapian said in a statement that the latest security breach caused it to lose 17% of its total assets. The company didn’t specify the type of virtual currencies that were stolen or the financial value of its losses. In April, Youbit, formerly called Yapizon, lost 4,000 bitcoins now worth $73m to cyberthieves.

Users of the exchange with digital coins in their online accounts were told by Youbit on Tuesday that they could withdraw about 75% of their cryptocurrency for the time being. The remaining balances would be returned after the company goes through bankruptcy proceedings, it said.

It said it was “very sorry” that it had been forced to shut down.

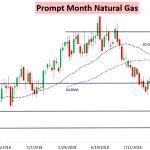

Once again, however, the dip in BTC is being bought off the lows…

Ethereum had surged overnight (touching almost $900 in overnight trading) but was also sold on the Korea news…

However, on the positive catalyst side, CoinTelegraph reports that in 2018 central banks will hold cryptocurrency, alongside gold and foreign currencies, according to the CEO of Blockchain.info, Peter Smith.

Speaking in a short interview on CNBC’s Coin Rush segment, Smith forecast that next year would see the first such incorporations of crypto into traditional financial institutions, saying:

“I think this year will be the first year we start to see central banks start to hold digital currencies as part of their balance sheet.”

Leave A Comment