The November property price data out of China confirmed what we’ve been talking about for a while now (before most others caught on); the cooling off of the current price boom, and the prospects of a slowdown in 2018. This is a critical theme to be across because it involves a number of key global macro trends and impacts significantly on the macro/risk outlook in China, and indirectly has a big impact on emerging market equities. For active asset allocators, these are all key issues!

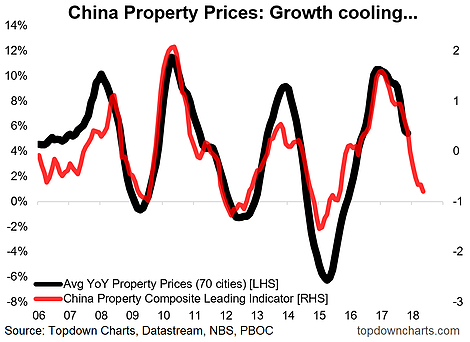

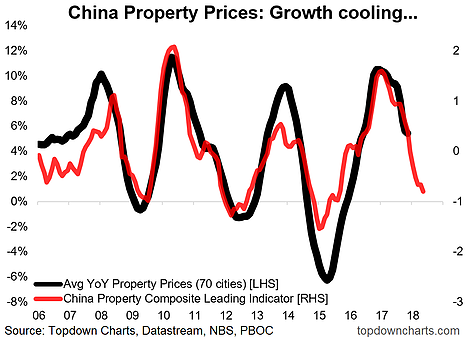

Focusing on the final point – emerging market equities, as the charts below show the Chinese property market has begun to cool off. Our leading indicator (which combines interest rates, money supply, and capital market conditions) points to a further cooling and potential slowdown in 2018. The next chart shows how property prices impact on China’s producer price inflation. The final chart brings this into clear and meaningful context: a slowdown in property prices in China will most likely lead to a slowdown in producer price inflation, and historically the experience is that emerging markets struggle in that environment.

The reasons include the commodity channel (commodity prices matter for a lot of emerging markets e.g. Brazil, Russia, South Africa), the China demand and trade channel (particularly Asian emerging economies rely on export demand from China – slowed PPI reflects a weaker Chinese economy, hence weaker demand), and the overall macro risk sentiment channel (producer price deflation played into the global deflation scare and served as a headwind to global risk sentiment). So it’s a couple steps removed, but the flow-on effects are clear and economically significant. Our view is this could be one of the major themes for global markets and asset allocation in 2018, so ignore it at your peril.

As flagged by our composite leading indicator, Chinese property price growth is cooling rapidly.

Typically producer price inflation in China follows property price growth. This is for a number of good reasons such as the commodity intensive nature of property construction, and flow-on demand.

Leave A Comment