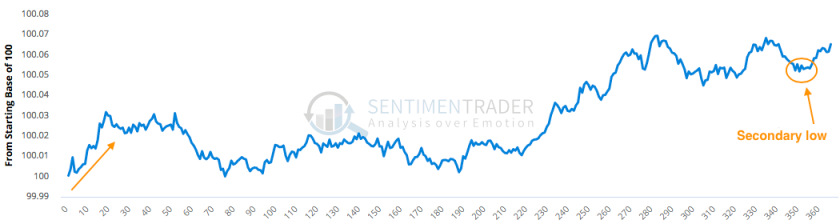

We have been expecting a seasonal rally in gold, silver and the miners off of a bottom due in either December or January, as is typical of the sector. I’ve marked up Sentimentrader‘s seasonal gold pattern to show the secondary low made (on average over 30 years) in December and the January ramp up that follows (on average).

But we’ve long contended that noise about global strife (geopolitics), inflation and most of all China/India demand need to be tuned out and the larger component planets of the Macrocosm ™ need to be respected in order to call a real bull market phase in gold and gold stocks.

Taking a quick look at the largest components, gold vs. stock markets is still bearish and the economy – new corporate welfare tax package all but in the bag – is doing just fine.

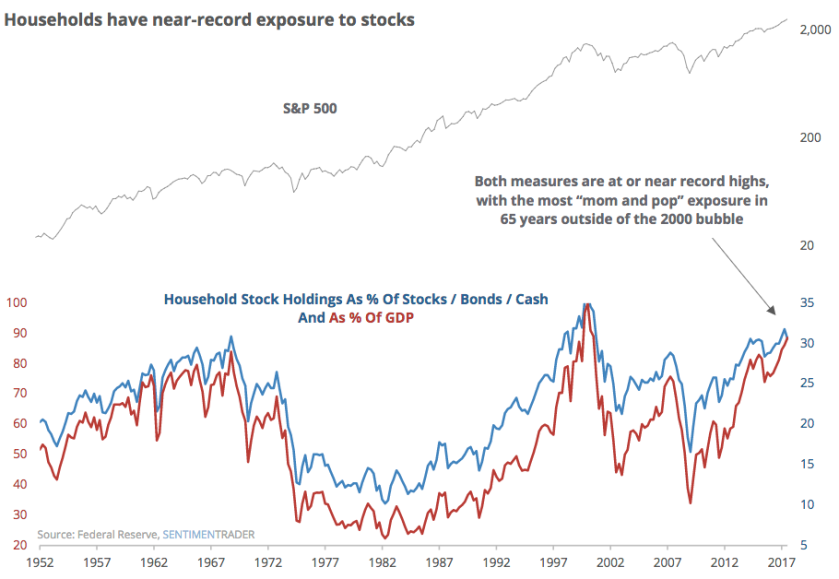

NFTRH in general and I personally am in line with this reality, long various stocks/ETFs in line with the good times. But I tell you now that Mom and Pop are very much in da’ house and they are gonna be really wrong footed when the Wall Street wise guys eventually pull the rug out.

What will be the trigger? Sell the corporate tax welfare news (which the market has been discounting all along)? New year selling due to 2018’s sure to be beneficial capital gains tax environment? Or just that everyone who’s gonna buy will have bought (that’s you, Mom and Pop). Again from Sentimentrader…

Herein would lie the case for gold and gold stocks’ fundamentals. We are continually updating the 3 Amigos theme (one of which is stock markets vs. gold) in order to cross reference indicators from multiple angles; but a market watcher with common sense may well look at the information above and this chart below, and just conclude… it’s coming time.

Or we can try to pick a finer point using a rather important Amigo, the S&P 500 vs. gold. Noted is a logical termination area for the wondrous, man made stock bull market that was the beneficiary of massive amounts of unconventional inflation policy, post 2008.

Leave A Comment