Today was likely to be Janet Yellen’s last FOMC meeting as the Chairperson.

The Fed raised their key interest rate by 25 basis points.

Chair Yellen has agreed to resign when her successor, Jay Powell, is approved by the Senate.

And so the tending of the third post-regulatory asset bubble is passing from Janet to Jay, as its forebears have passed from Alan to Ben.

Well, such are the times.And since some have done it so well, many others are joining in.Truth is too often led down a blind alley and strangled, willfully.And people look aside, based on their own personal advantage.

Bitcoin stumbled a bit. As did the dollar.

There is so little understanding of the fundamentals of monetary value today and its foundation in history that one might despair of our ability to avoid one of the substantial failures and conceits of the will from the past.

The spirit of John Law is alive and well, and stalking the halls of the academy and the fevered brains of the ‘latest and greatest’ innovations in money creation, the less unfettered the better, once again.

The FCC looks set to put an end to ‘net neutrality.’This is the beginning of the end for the internet as we have known it.I would hope that the Congress can do something to override it, but I am not hopeful in their integrity.

Don’t give yourself away to the worldly powers too easily.The lies are flying thick and fast from both sides.

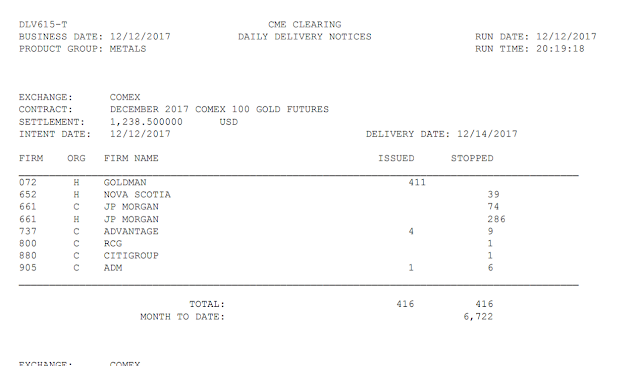

Gold managed a nice rally back off the FOMC day. Wow, who could have expected that? This guy.

And silver joined in and took back the 16 handle.

Stocks were lackluster.

I doubt we will see any sustained selling into the end of the year.The volumes are likely to be too light for that, although we should expect some ‘portfolio rebalancing.’

Leave A Comment