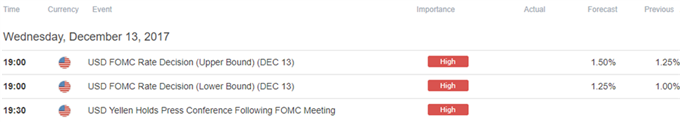

The Federal Open Market Committee’s (FOMC) last interest rate decision for 2017 may spark a bullish reaction in the U.S. dollar as the central bank is widely expected to lift the benchmark interest rate to a fresh threshold of 1.25% to 1.50%, but the fresh projections from Chair Janet Yellen and Co. may drag on the greenback should a growing number of central bank officials project a more shallow path for the benchmark interest rate.

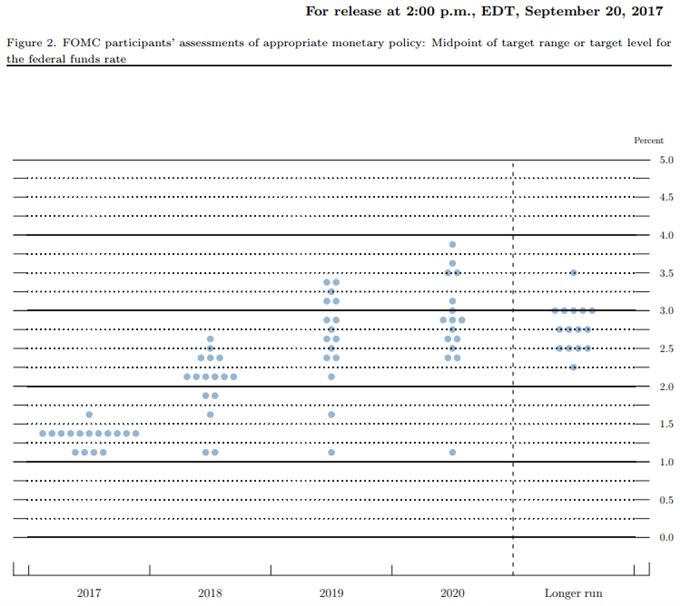

The FOMC may opt for a dovish rate-hike as ‘many participants observed that there was some likelihood that inflation might remain below 2 percent for longer than they currently expected,’ and the central bank may largely endorse a wait-and-see approach for 2018 as ‘several participants expressed concern that the persistently weak inflation data could lead to a decline in longer-term inflation expectations or may have done so already.’

In turn, a downward revision in the longer-run forecast for the benchmark interest rate is likely to produce a bearish reaction in the greenback as the Fed runs the risk of completing its hiking-cycle ahead of schedule, and the dollar may exhibit a more bearish behavior ahead of the upcoming rotation within the FOMC as the central bank struggles to achieve the 2% target for price growth. Interested in watching the market reaction? Sign up and join DailyFX Chief Currency Strategist John Kicklighter LIVE to cover the FOMC interest rate decision.

Impact that the FOMC rate decision had on EUR/USD during the previous meeting

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

NOV

2017

11/01/2017 18:00:00 GMT

1.00% to 1.25%

1.00% to 1.25%

-3

-7

Leave A Comment