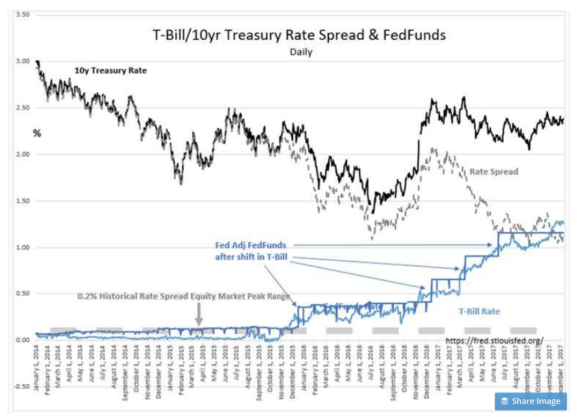

The Yellen Fed has been painfully slow to ratchet rates up to levels required by the US economy. As “Davidson’s” chart below shows that historically the Fed Fund rates had been set ~.2% away from the 10yr. Treasury. Today that difference is ~1%. It’s far too early to quantify exactly the ramifications of this but one has to wonder:

When this experiment is over, of course, the answers will be crystal clear (everything is in hindsight). One thing is clear though, the rate spread has never been this large and things like this affect investor behavior. It also adds a certain layer of unpredictability in credit markets and when you have a market that size, sudden ripples there can cause major waves across other asset classes.

The Fed is now playing catch with rates…..a raise now is virtually certain….

Leave A Comment