The November employment numbers led to positive headlines and the 228,000 new jobs beat expectations for 200,000 new jobs. At the same time, unemployment remained low at 4.1%. Of course, all of this is good news.

Some stories noted disappointment with wage growth. Average hourly earnings are up just 2.5% on an annualized basis. Economists expected a 2.7% gain.

But wage growth is stronger than reported. It’s good enough that the Federal Reserve should be worried about inflation. Average earnings are up 2.9% compared to a year ago.

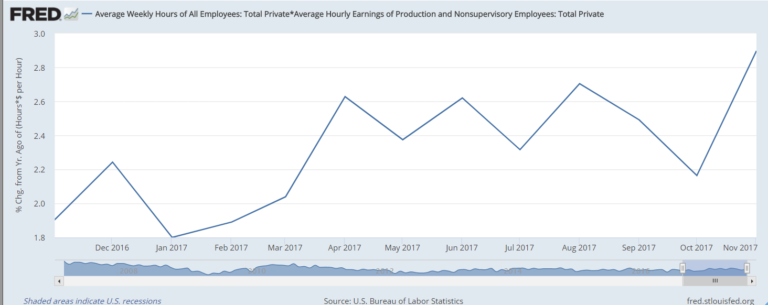

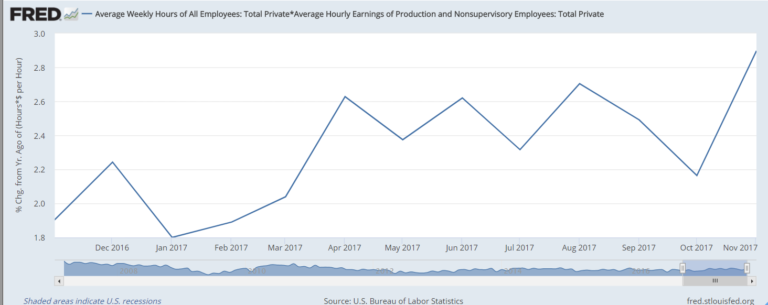

Earnings grow when wages or hours worked increase. So, economists need to multiply average hours worked times average wages to see what earnings are.

This number, as shown above, is growing nearly 3% a year. Workers want more than that. But economists worry that’s already too high.

When earnings grow faster than inflation, economic theory tells us that inflation follows. That’s what the Fed is worried about, and that’s why a Fed interest rate hike is likely to happen this week.

Higher earnings in the past few months explain the higher rates we are already seeing.

The interest rate on one-year Treasury bills doubled to 1.68% in the past year. It’s now at the highest level since the financial market crash of 2008.

From here, rates should continue rising. It’s entirely possible checking accounts will pay 1% a year from now. That’s a step welcomed by consumers but a sign that inflation is heating up.

Leave A Comment