AUD/USD traded higher today, extending its gains on the back of U.S. dollar weakness. While there were no Australian economic reports released overnight, AUD/USD traders were relieved that Australia has also been granted an exemption from Trump’s trade tariffs. Although Australia’s steel and aluminum exports are nominal (only about US$213 million each), psychologically this decision highlight the strong relationship between the U.S. and Australia although both parties denied that this had anything to do with military support.

Regardless, the Australian economic calendar is light with the exception of some speeches from RBA officials this week – the last we heard from RBA Governor Lowe, although they maintain a firmly neutral policy the next RBA rate move will be up not down because the economy is moving in the right direction as non-mining spend rises by the largest amount since the financial crisis.

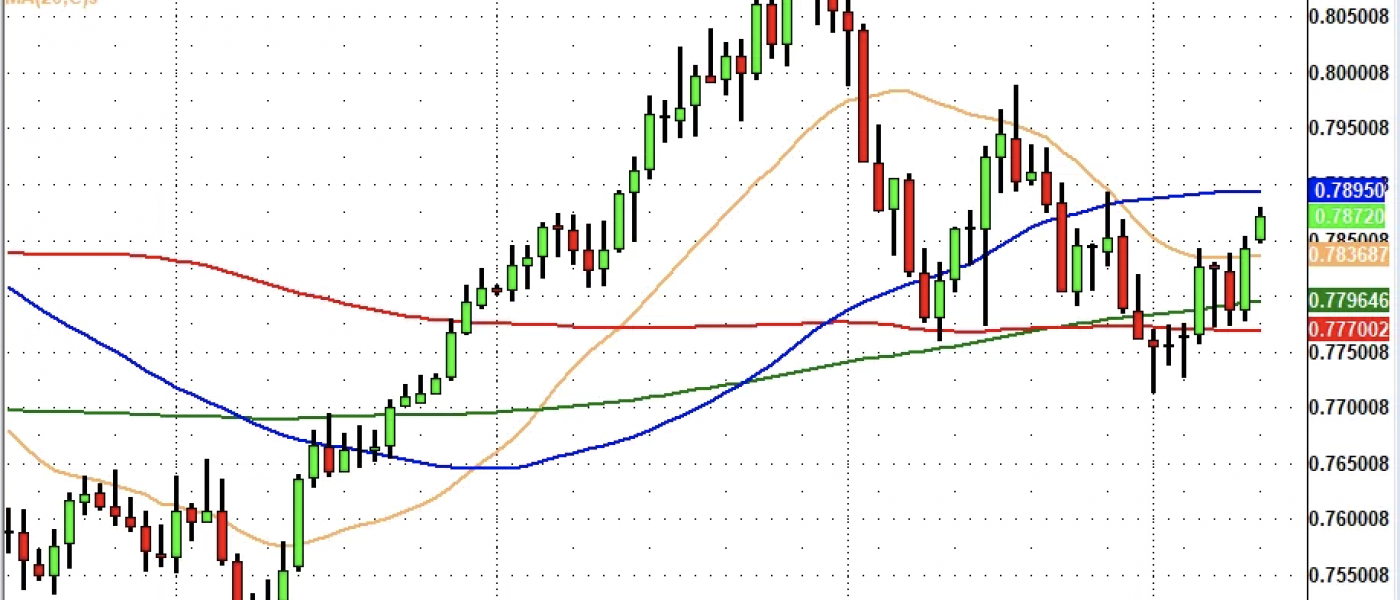

Technically, AUD/USD broke out of a 4 day consolidation and appears poised for a move to at least 79 cents. The 50-day SMA sits at .7893 and if that is broken, the next stop for AUD/USD should be the Feb 16th high of .7988. If AUD/USD fails at .79 cents and moves back below .7835, the losses could take the pair to the bottom of its recent range near .7780.

Leave A Comment