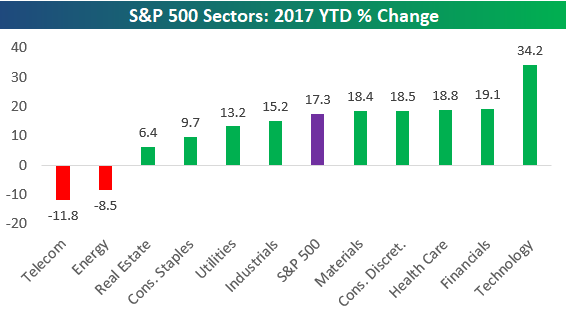

Below is a quick look at S&P 500 sector performance so far in 2017. As shown, even after a pullback over the last week or so, Technology is still up double the S&P 500 with a gain of 34.2%. The next best sector is Financials with a gain of 19.1%, followed by Health Care (18.8%), Consumer Discretionary (18.5%), and Materials (18.4%).Telecom and Energy are both down 8%+ on the year.

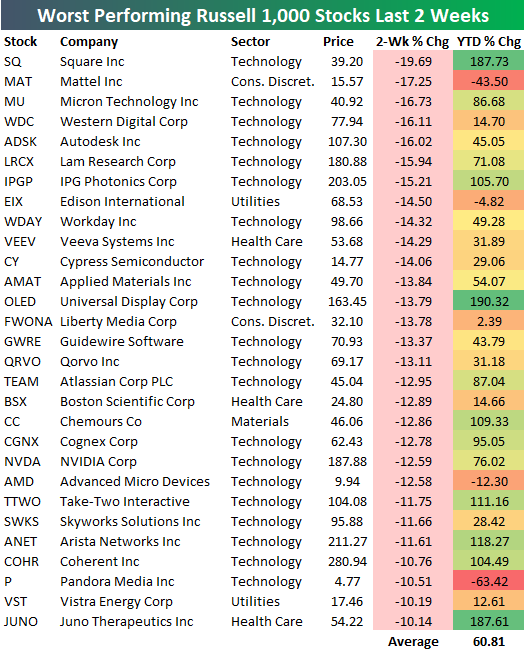

Over the last two weeks, we’ve seen the year’s biggest winners take a beating, while investors have shifted a bit into value stocks that had been underperforming. Below is a list of the biggest losers in the Russell 1,000 over the last two weeks. All of these stocks are down 10%+ over the last 10 trading days, and as you can see, there are quite a few of them!

On average, these stocks are up 60% year-to-date, which shows that investors have been selling the biggest winners.

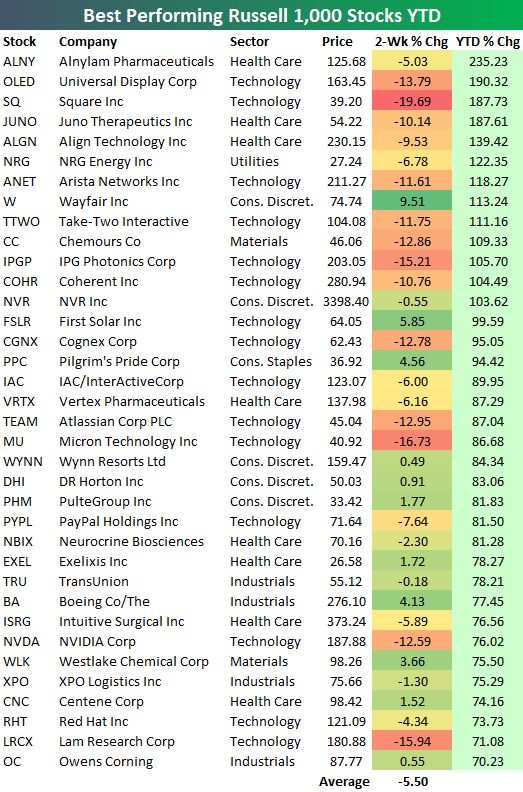

Another way to highlight the recent weakness in the year’s winners is to look at the two-week performance of the stocks that are up the most year-to-date. Below is a list of the top performing stocks in the Russell 1,000 year-to-date. As shown, these stocks are down an average of 5.5% over the last two weeks. Over this same two-week period, the S&P 500 is up 1.18%.

If you’ve had a great year thus far in the stock market, you’ve likely given some back over the last two weeks!

Leave A Comment