Bitcoin set a new milestone on Wednesday when the dominant cryptocurrency crossed $12,000 a coin amid speculation CME and Nasdaq exchanges are working on listing the coin on their futures platforms.

According to experts, this move will help legitimize the unregulated digital currency and position it for mainstream investors.

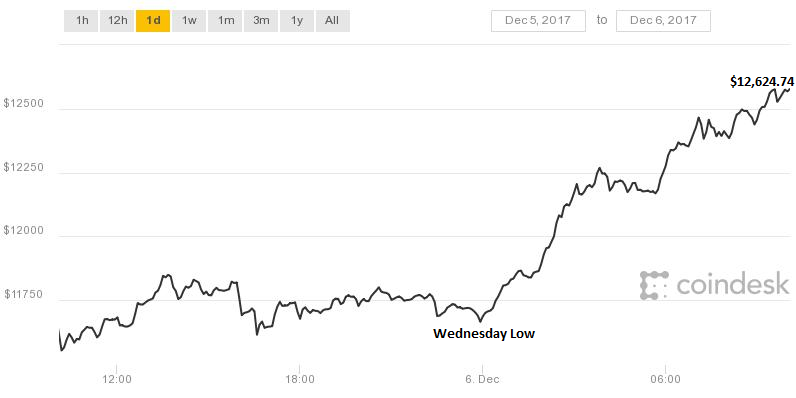

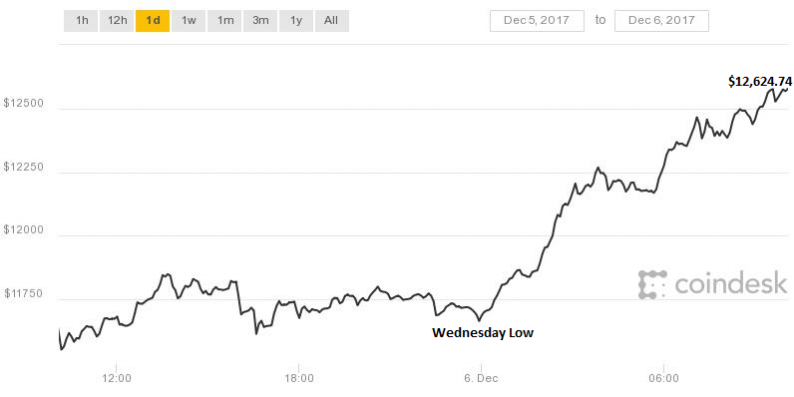

The Bitcoin Price Index (BPI) jumped to $12,624.74 a coin on Wednesday during Asian trading session to set a new all-time record. This upsurge represents a gain of $1,229.7 or 10.3 percent from $11,395 recorded in November and boosted Bitcoin market capitalization above $205 billion for the first time since the index was launched.

Despite gaining over 1,000 percent in 2017, experts are still skeptical of the high flying unregulated cryptocurrency.

According to Stephen Roach, a Yale University senior fellow and former Asia Chairman and chief economist at investment bank Morgan Stanley, “This is a toxic concept for investors,” Roach, described by Yale as one of Wall Street’s most influential economists, told CNBC. “This is a dangerous speculative bubble by any shadow or stretch of the imagination.”

“I’ve never seen a chart of a security where the price really has a vertical pattern to it. And Bitcoin is the most vertical of any pattern I’ve ever seen in my career,” he asserted.

Leave A Comment