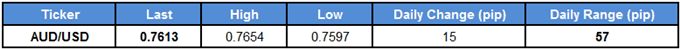

AUD/USD climbs to a fresh weekly-high (0.7654) following the 0.5% rise in Australia Retail Sales, and the pair may stage a larger advance over the remainder of the week as the 3Q Gross Domestic Product (GDP) report is anticipated to show the economy expanding an annualized 3.0%.

The above-forecast reading for retail spending accompanied by a pickup in the growth rate may heighten the appeal of the Australian dollar as raises the outlook for inflation, and the Reserve Bank of Australia (RBA) may come under pressure to remove the record-low cash rate as ‘the central forecast is for GDP growth to average around 3 percent over the next few years.’ As a result, Governor Philip Lowe and Co. may gradually change their tune in 2018 as the central bank headnotes ‘it is more likely that the next move in interest rates will be up, rather than down,’ but a batch of mixed GDP figures may keep the RBA on the sidelines for the foreseeable future as ‘household incomes are growing slowly and debt levels are high.’

Keep in mind, the broader outlook for AUD/USD remains tilted to the downside as the pair remains confined by the descending channel carried over from September, but the pair may stage a more meaningful rebound off of channel support as the Relative Strength Index (RSI) deviates with price and appears to be breaking out of the bearish formation from the summer months.

AUD/USD Daily Chart

Leave A Comment