What are high yield bonds? I don’t mean the textbook definition (corporate bonds with a credit rating below BBB), but how they actually behave in terms of risk and return.

In attempting to answer this question, let’s address some common myths surrounding the asset class affectionately known as “junk bonds.”

Myth #1: High Yield Bonds Act More Like Bonds than Stocks

Junk bonds are bonds, so they should act more like other bonds than stocks, right?

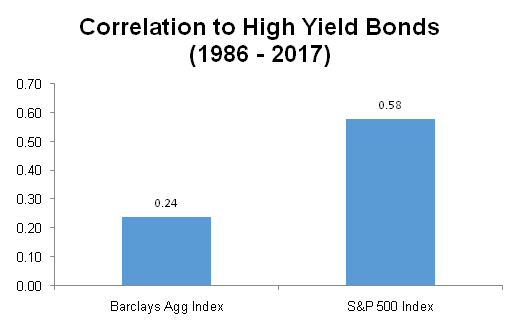

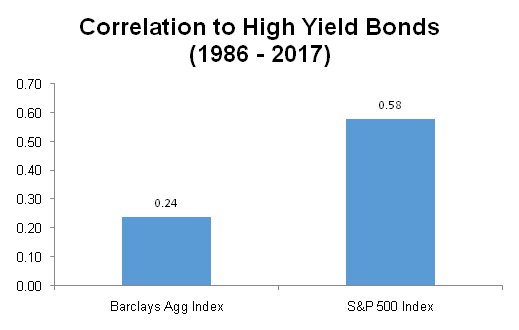

Wrong. With a correlation to stocks of 0.58 and a correlation to bonds of 0.24, junk bonds are more likely to move with the U.S. stock market than the aggregate bond market.

Note: Throughout this post I am using the BofA Merrill Lynch High Yield Bond Index (total return) as a proxy for high yield bonds. This index dates back to September 1986.

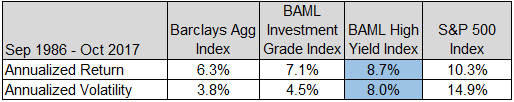

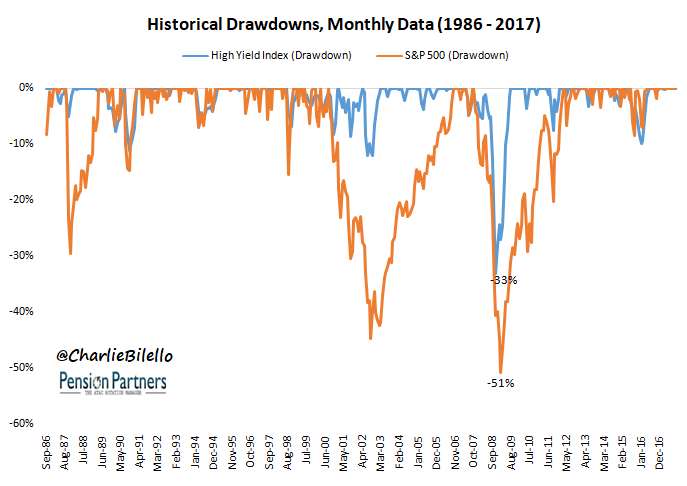

Myth #2: High Yield Bonds are Riskier than Stocks

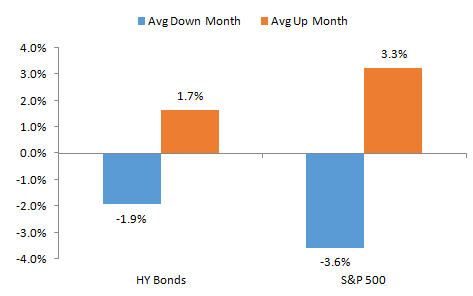

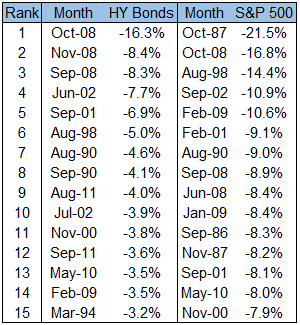

When junk bonds are down more than stocks (13% of all months), we often hear that they are riskier than stocks. While that may appear to be the case at times, their overall risk profile does not support such a conclusion:

Myth #3: High Yield Bonds Always Move Up/Down with Stocks

Just because junk bonds are correlated with stocks over the long run doesn’t mean they always move in the same direction. Historically, they have moved together in 76% of months. That means in roughly 1 out of every 4 months, or 3 times per year on average, they are moving in opposite directions.

Leave A Comment