Global oil investors have started holding back on growing U.S. oil rigs, even as OPEC promise to extend production cuts through the end of 2018.

U.S. oil rigs rose to 749 last week, the largest level since September, according to Baker Hughes report. Prompting investors and traders to pullback on concern that growing Shale production will disrupt of OPEC ongoing strategy.

“The OPEC deal will mostly work for non-OPEC,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “Even if OPEC delivers the cuts promised, and prices stay high long enough, the main result will be that U.S. shale adds on close to 1 million barrels a day of additional production.”

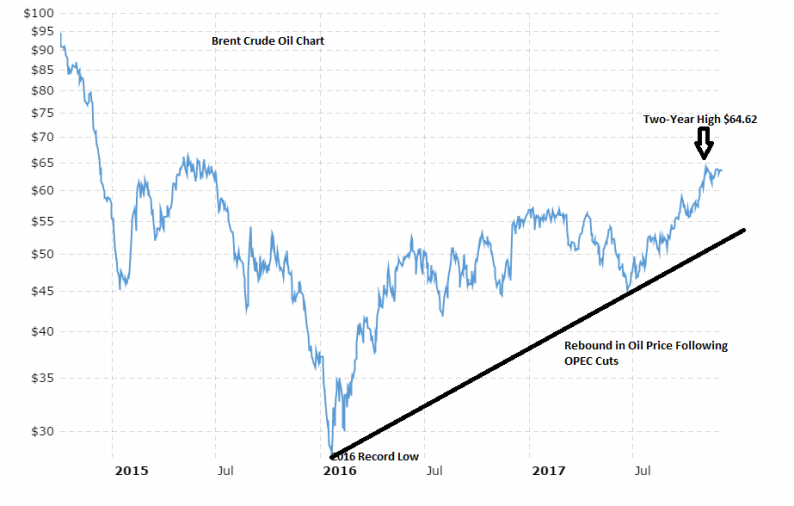

Global benchmark crude, Brent crude shed 0.9 percent to $63.16 a barrel, down from $63.73 it closes on Friday, while the US West Texas Intermediate dropped 1 percent to $57.80 a barrel down from $58.32 recorded on Friday.

In an effort to further balanced global crude oil, the OPEC last week in Vienna included Nigeria and Libya in production cuts by capping Nigeria production at 1.8 million barrel per day and Libya at 2017 production level.

The Nigerian Minister of State for Petroleum Resources, Dr. Ibe Kachikwu said: “Our current production is 1.75, we are still below the 1.8 that was the benchmark which is comfortable but you’re going to see a lot more pressure as we go into next year.”

“Our contribution is fairly limited because we are still lacking in that capacity to reach the marks anywhere soon.”

Leave A Comment