While the broad market has been turbulent for the start of 2018, clean energy stocks have fared worse than most. The Trump administration’s anti-environmental efforts had little effect on clean energy stocks in 2017 (it was a banner year for this model portfolio). So far, this year has been quite different. Last year, investors seemed unfazed by the chaos in Washington, but with the single “win” of the Republican tax give-away to corporations, investors now seem to think that Trump may indeed be able to deliver on his polluter-funded agenda.

Income-oriented stocks have also been taking a beating, and the Federal Reserve expresses concern about the rapidly expanding deficits caused by the Republicans’ irresponsible fiscal policies. In the long term, higher interest rates will be good for savers, who will be able to earn a higher return on our investments. In the short term, prices of income producing stocks will have to adjust downward in order to deliver higher yields.

The below-market sale price for Yieldco 8point3 Energy Partners (NASD: CAFD) has also spooked Yieldco investors. 8point3’s situation was largely unique among Yieldcos. I warned readers repeatedly about its overvaluation in 2017, saying that it was unlikely to find a buyer at any price over $13 per share. Nevertheless, the below market sale price of $12.35 may be making investors in other Yieldcos wonder if something similar could happen to them, and that fear seems to be driving down the prices for other Yieldcos.

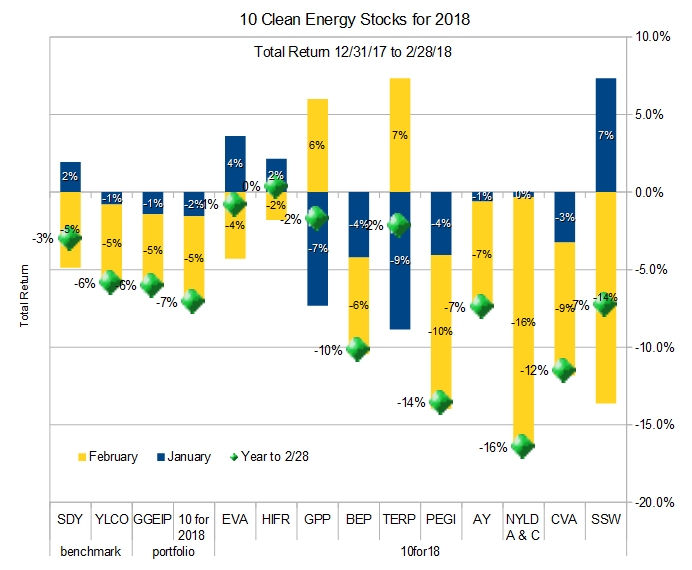

Overall, my broad market benchmark SDY fell 3.0% for the two months, my clean energy benchmark YLCO fell 5.9%, and the model portfolio of ten clean energy stocks fell 7.1%. The real-money Green Global Equity Income Portfolio (GGEIP), which I manage was down 6.1%. You can now follow the Green Global Equity Income Portfolio. Investors who pay a monthly fee can also see the components of the actual portfolio and trades. This should give you insight into the many stocks I own that are not in my annual top ten lists, as well as insight into my options strategy.

Stock discussion

Below I describe each of the stocks and groups of stocks in more detail. I include with each stock “Low” and “High” Targets, which give the range of stock prices within which I expect each stock to end 2018.

Seaspan Corporation (NYSE:SSW)

12/31/17 Price: $6.75. Annual Dividend: $0.50 (7.4%). Expected 2018 dividend: $0.50 (7.4%). Low Target: $5. High Target: $20.

2/29/18 Price: $6.15 YTD dividend: $0.125 (1.85%) YTD Total Return: -7.3%

Leading independent charter owner of container ships Seaspan missed analysts’ earnings estimates on February 28th, but the company’s financial strength and market position remains strong. Further, the container shipping industry continues to recover and Seaspan’s dividend is well protected. Unless Trump starts a global trade war that greatly impacts global shipping volumes, investors who buy at the current price are likely to be very happy. I have been slowly shifting my exposure to Seaspan from the preferred (SSW-PRG, etc.) shares into the common shares.

Covanta Holding Corp. (NYSE:CVA)

12/31/17 Price: $16.90. Annual Dividend: $1.00(5.9%). Expected 2018 dividend: $1.00 (5.9%). Low Target: $15. High Target: $25.

2/29/18 Price: $14.95 YTD dividend: $0 (0%) YTD Total Return: -11.5%

US leader in the construction and operation of waste-to-energy plants Covanta also had slightly weaker than expected earnings in 2017. The causes were the delayed re-opening of one of its larger plants in Fairfax Connecticut and slower than expected start up of its new waste-to-energy facility in Dublin. Since these are both one-off factors I expect the company to produce much stronger results in 2018, with both the Fairfax and Dublin facilities fully operational. Assuming no new mishaps, there will also be a small boost from insurance recoveries related to 2017 Fairfax down time which will boost 2018 results.

Leave A Comment