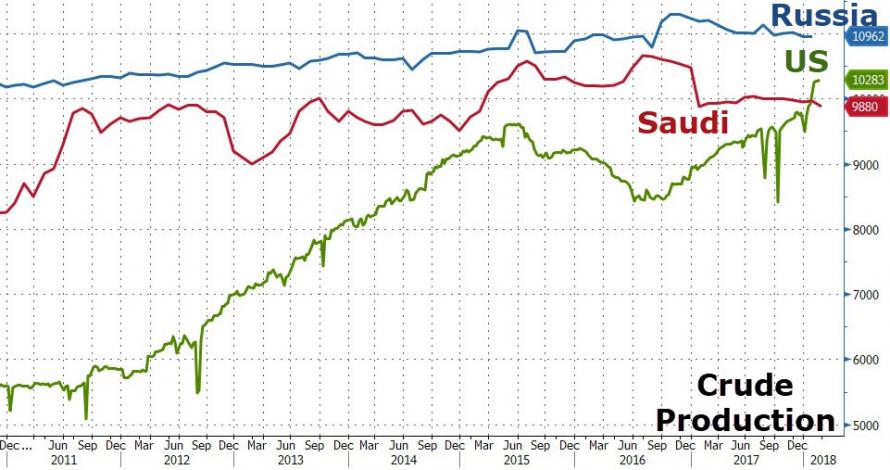

Last month, the US accomplished a historic achievement: thanks to soaring shale production, America surpassed Saudi Arabia as the world’s second largest oil producer, pumping over 10 million barrels per day, while Saudi Arabia remains stuck just below the key mark as a result of the ongoing self-imposed production limit, meant to push the price of oil higher (a boon to US shale producers) and to reduce the global inventory overhang. Meanwhile, the world’s top producer, Russia, remains safely in first place, with a daily output of roughly 11 million bpd.

That, however, is set to change however in the coming years according to the International Energy Agency, which in its highly anticipated Oil 2018 report released overnight predicted that the U.S. will overtake Russia to become the world’s largest oil producer by 2023, accounting for most of the global growth in petroleum supplies.

The IEA now expects the US to reach a record of 12.1 million barrels a day in 2023, up about 2 million barrels a day from this year, in the process surging past Russia. Furthermore, the IEA predicted that of the 6.4 million new barrels of oil that will be pumped every day between now and 2023, almost 60% will come from the U.S., the IEA said.

While Saudi Arabia’s crude-output capacity is also expected to gros substantially, and reach 12.3 million barrels a day in 2023 – meaning it could rival the U.S. for the top spot as a producer – the Saudis have historically pumped well below their capacity to maintain their importance as a so-called swing supplier that could increase or decrease output as the market needs.

Meanwhile, counting all liquids, including those derived from natural gas, U.S. production will rise to nearly 17 million barrels a day over the next five years from about 13 million today, the IEA predicted, far more than Saudi Arabia or Russia.

* * *

As the WSJ reports, the IEA’s closely watched five-year forecast showed the U.S. hitting new strides in its oil and gas boom, “helped by technological advances, improved efficiency and a fragile recovery in oil prices that is encouraging shale companies to ramp up their drilling.”

Leave A Comment