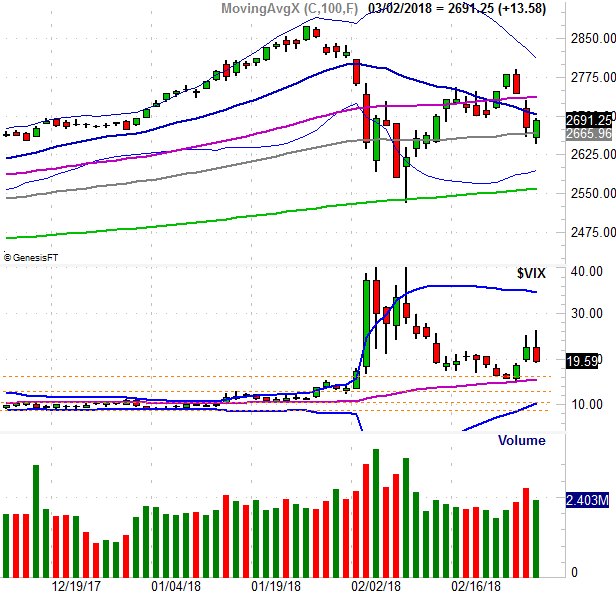

The market may have been up on Friday, but it wasn’t really enough to offset the loss booked for the whole week. Regardless, stocks remain in a proverbial no-man’s land, under some key resistance lines and above a key support levels. Traders just aren’t sure what to do here, struggling to figure out if an accelerated rate-hike program is a bad thing, or a sign of just how strong the economy is.

We’ll weigh it all below, as always, but first let’s look at last week’s and this week’s economic announcements. More than usual, investors are looking at that data to make a judgment call about the market’s foreseeable future.

Economic Data

Busy week last week, in terms of economic news. Let’s just dive in, beginning with (more or less) order of appearance.

Rounding out the prior week’s existing home sales numbers that were not only tepid but worse than anticipated, January’s new home sales were also disappointing at a pace of 593,000. Inventories are still on the low-ish side, but we’ve prodded more home sales with less inventory in the recent past.

New and Existing Home Sales (Annualized) and Inventory Charts

Source: Thomson Reuters Eikon

Maybe it was the month. Maybe extremely cold weather kept buyers from looking, and maybe the seasonal adjustment didn’t fully account for the usual January lull. It’s unlikely interest rates soared to the point where would-be buyers changed their mind. Our fear is that this is simply an indication of a garden variety slowdown.

The good news is, the homes that are selling are selling at ever-increasing prices.

While it’s December data and therefore a bit dated, both the Case-Shiller Index of home prices and the FHFA Housing Price Index edged higher at the end of last year, extending a long-standing streak.

Case-Shiller and FHFA Housing Price Index Charts

Source: Thomson Reuters Eikon

It was also a big week for consumer sentiment, with the Conference Board’s score of confidence being posted on Wednesday followed by Friday’s third and final reading of consumer sentiment for February. In both cases, despite a horrific start to the month for stocks, people are even more upbeat about what they see coming later this year. The Conference Board figure even hit a multi-decade high.

Leave A Comment