As expected, Cyber Monday hit records all across the retail industry. According to Adobe Insights, sales recorded by online outlets, including those of traditional brick and mortar stores, hit $6.59 billion. That’s a record not just for a Cyber Monday but any single day in the internet’s two decades of mainstream usage.

It was, Adobe said, a gain of 16.8% compared to last year. The analytics firm also estimates that online sales made last week on Black Friday were up 10% over 2016.

Retailers have been quick to tout their beefed up virtual presence, and their results, as noted yesterday. That’s all well and good if it means consumers are spending more overall. It doesn’t necessarily follow, however, as retail sales have been suggesting for some time. In other words, consumers are increasingly drawn to internet shopping out of necessity, meaning prices, prices, prices. A healthier condition would be driven by income and wage growth instead.

The National Retail Federation (NRF) had earlier promised a more comprehensive review of total Black Friday festivities, including sales recorded on Cyber Monday, to be released today. As of this writing, no data has been made available (when it is published I’ll update this post or if noteworthy put out a separate story). Thus, while news of online success permeates the mainstream narrative very little is being said about the whole consumer picture.

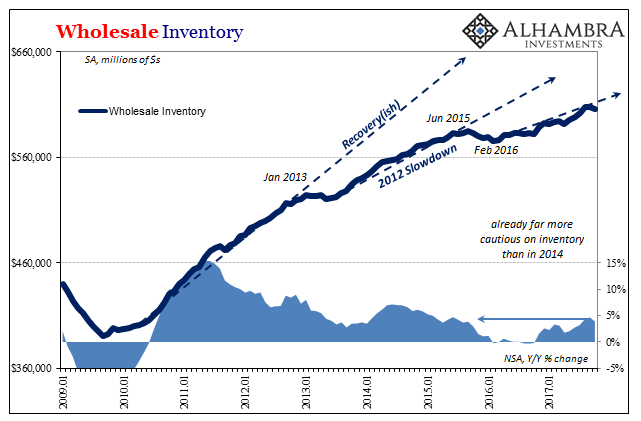

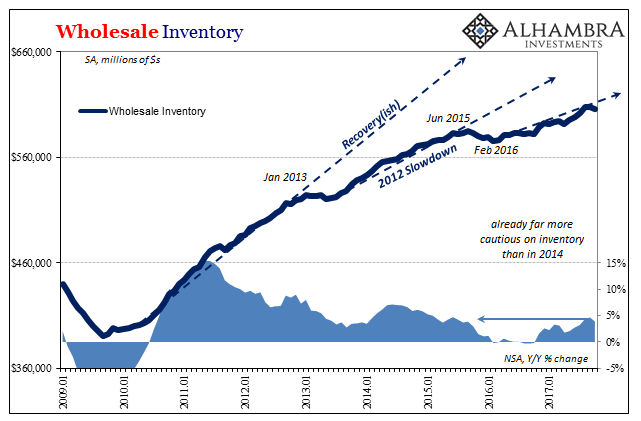

One notable data release that did take place as scheduled this morning does relate to that overall view of the current retailer experience. The Census Bureau reports in its advance release that wholesale inventories fell rather sharply in October 2017 – right in the middle of what was the buildup getting ready for the Christmas retail rush.

Though the advance inventory report for October doesn’t break down wholesale inventory by specific categories, including petroleum, as opposed to wholesale sales excluding petroleum inventories makes little difference in the overall inventory pattern and picture.

Leave A Comment