With the oil markets much closer to balance, geopolitical uncertainties are beginning to have a larger influence on the price of oil, something that hasn’t been the case for the last 2-3 years, Robert Rapier at R-Squared Energy recently told Financial Sense Newshour.

For related podcast, see Frank Barbera on Possible Market Top; Robert Rapier: “Fear Cycle” Returning to Oil Market

What’s Driving Oil Prices Now

Historically, the oil industry has cycled between fear and complacency, Rapier noted. A decade ago, the peak oil narrative was the driving force behind prices. Fear and negative news pushed the price higher.

Ultimately, this dynamic ushered in the shale oil revolution and we ended up with too much oil. Supply outstripped demand, he stated, and we shifted into the cycle of complacency.

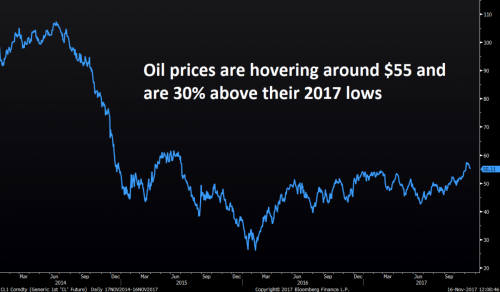

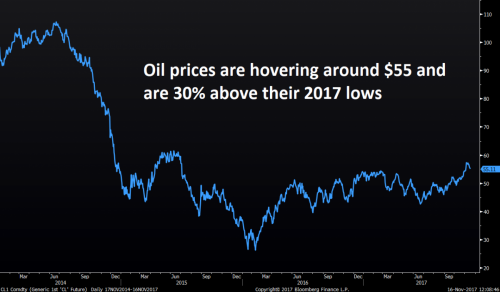

We’ve been in this cycle for around the past 3 years. Thus, any bullish news hasn’t really affected oil prices. We saw that hold true several times this year when a particularly large drawdown of oil inventories failed to move prices higher.

However, conditions are beginning to shift as we see global inventories continuing to come down and demand to grow strongly.

“Eventually we’ll get to that tipping point,” he said. “I think we are at that tipping point now where enough people realize the trends are headed in the direction of scarcity again, and that means the fear cycle could be returning.”

Geopolitics Back in Play

The world markets are beginning to remember how important Saudi Arabia is to world oil balance, and recent events revolving around the arrests of several Saudi royal family members have caught everyone’s attention.

Tensions with Iran may also lead to a reduction in supply.

“The instability in the area … makes the markets very nervous,” Rapier noted. “If we have any disruption in Saudi Arabia or Iran, we could run into a problem pretty quickly.”

Leave A Comment