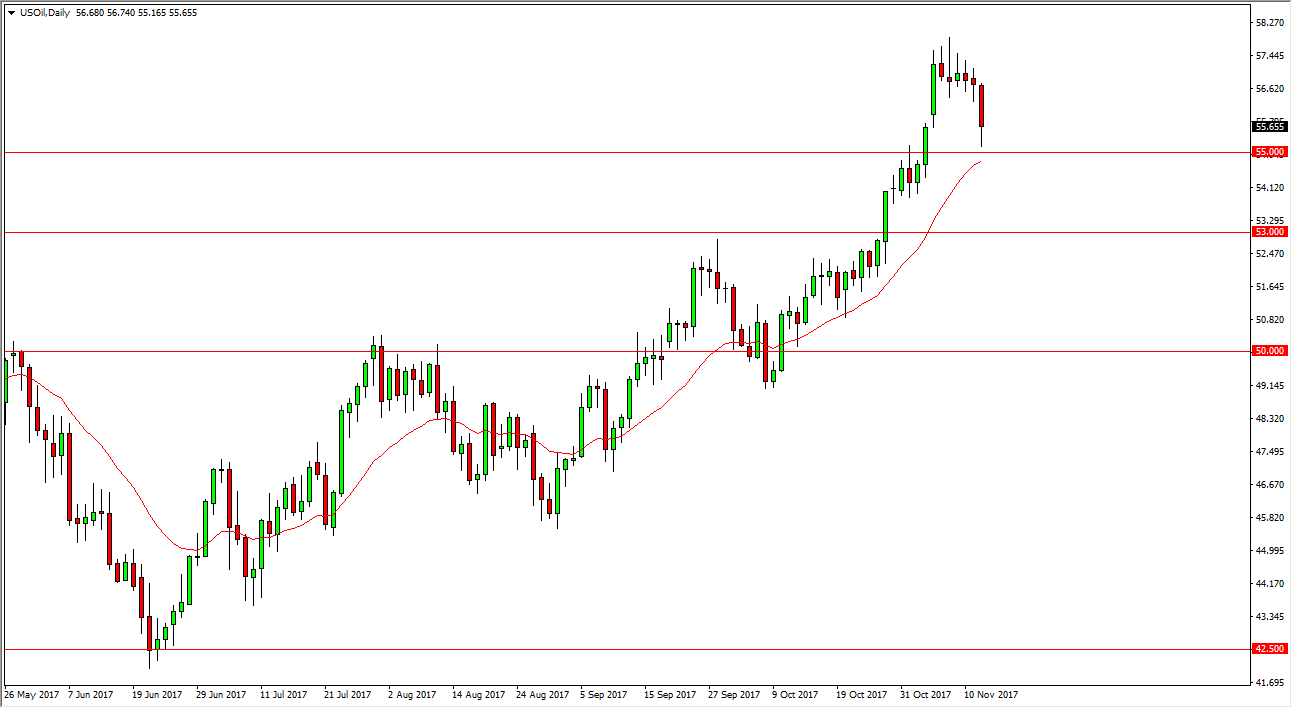

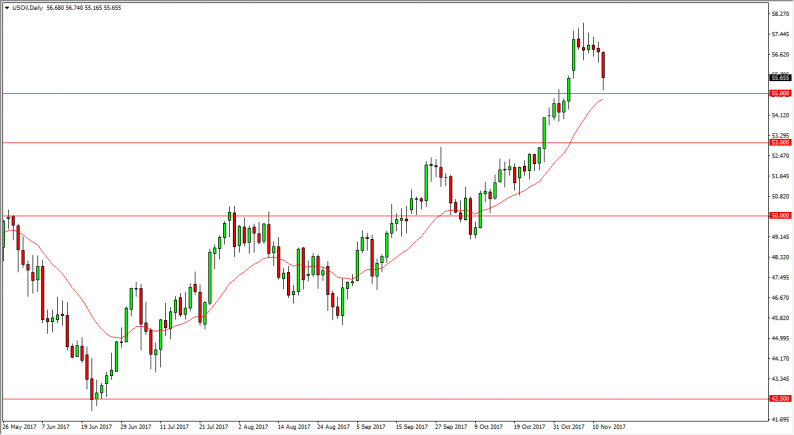

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Tuesday, reaching towards the $55 level for support. We did find it by the end of the day, but with today being the inventory announcement coming out of the United States, it’s likely that we will continue to see volatility. The market had gotten ahead of itself, so I believe that this pullback could be thought of as an opportunity to take advantage of value. In general, I believe that short-term traders continue to push oil markets higher but if we get too high, there is the possibility that US drillers come back into the market playful force. If we were to break down below the $55 level, I believe that the $53 level will be the next major support barrier. The $60 level above should be massive resistance.

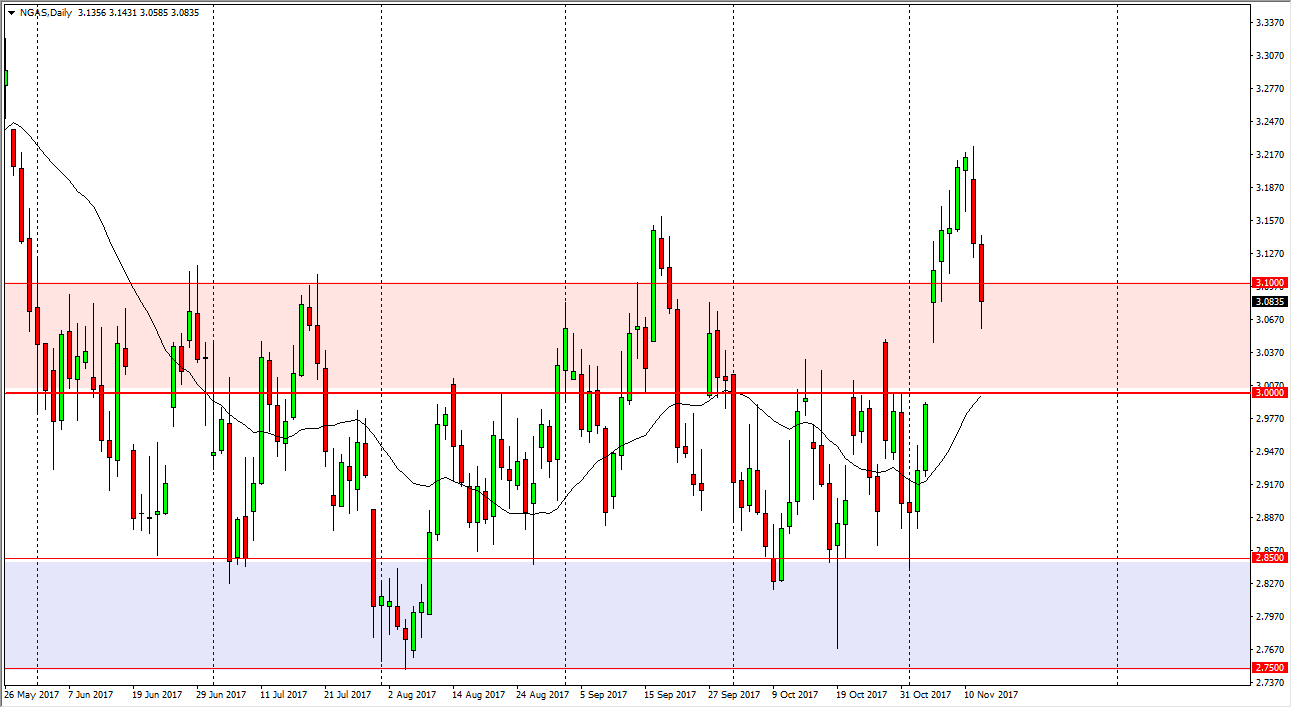

Natural Gas

Natural gas markets fell on Tuesday, slicing through the $3.10 level. There is a gap underneath, and we could go lower to go and fill that gap, which is quite common. However, I think that will only end up offering a nice buying opportunity, so I’d be very interested in going long on signs of a supportive bounce. If we were to break down below the $3 level, then the market could breakdown, but in the meantime, I think it’s more likely that the upward pressure continues to present itself, as the seasonality in the natural gas markets dictates more demand for both November and December. Once we get to the month of January, typically we roll back over. There are massive amounts of oversupply in this market, so longer-term I am bearish, but I also recognize that the seasonality is coming into play currently.

Leave A Comment