Some light selling across Large Caps and Tech indices meant there was little of interest for today’s action. The only action of note came in the Russell 2000.

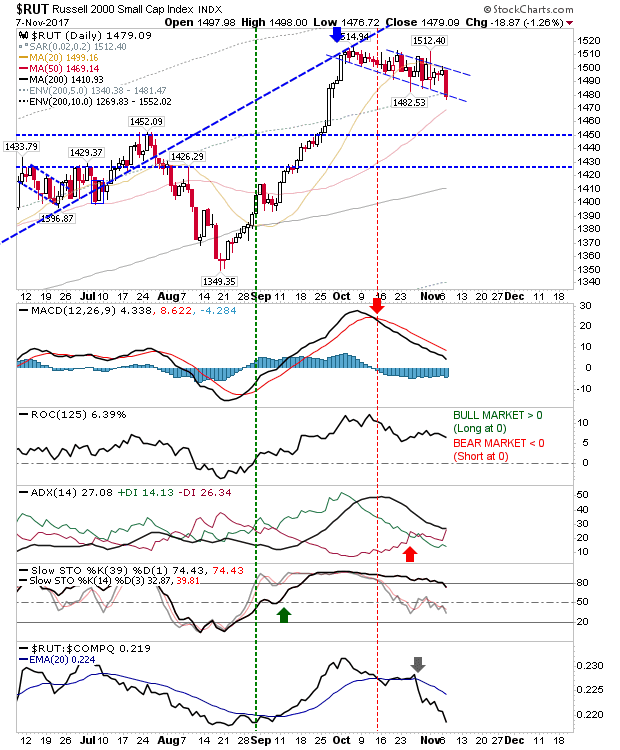

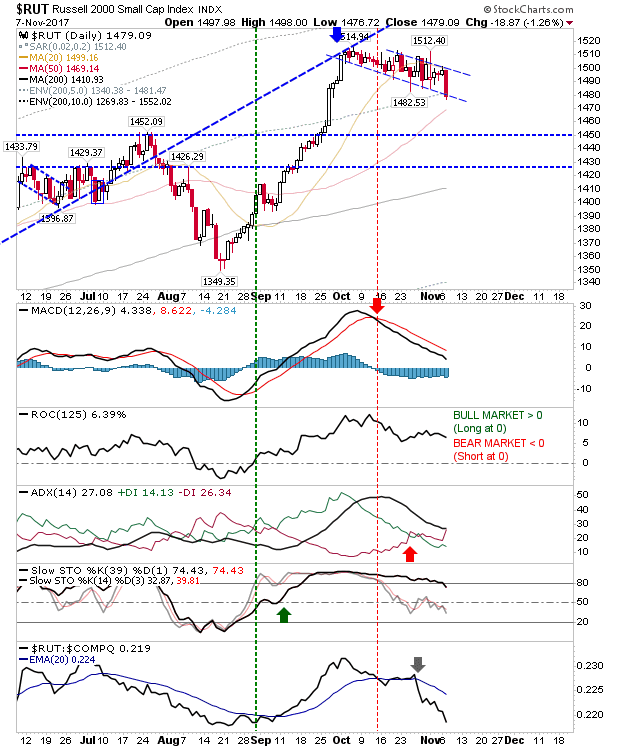

After inching towards ‘bull flag’ resistance the Russell 2000 took a leaf out of the sellers book and reversed back towards ‘bull flag’ support. It’s looking vulnerable to a further profit taking which would threaten ‘bull flag’ support, although the fast approaching 50-day MA could step in to help. Technicals are weak and weakening as relative performance swings away from Tech (strongly away) and Large Caps. A failure at the 50-day MA would next open the 200-day MA; at the latter point, I would expect Stochastics [39,1] to be oversold.

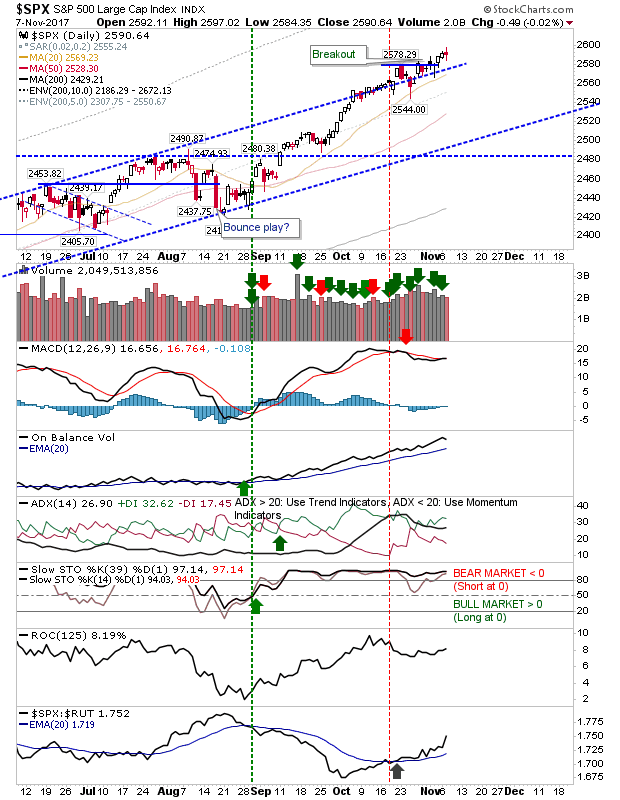

The S&P finished with a neutral ‘doji’ after posting new highs. Keep an eye on the MACD trigger line; it looks ready to generate a new ‘buy’ signal well above the bullish zero line. Other technicals – including relative performance – are firmly in the bull camp.

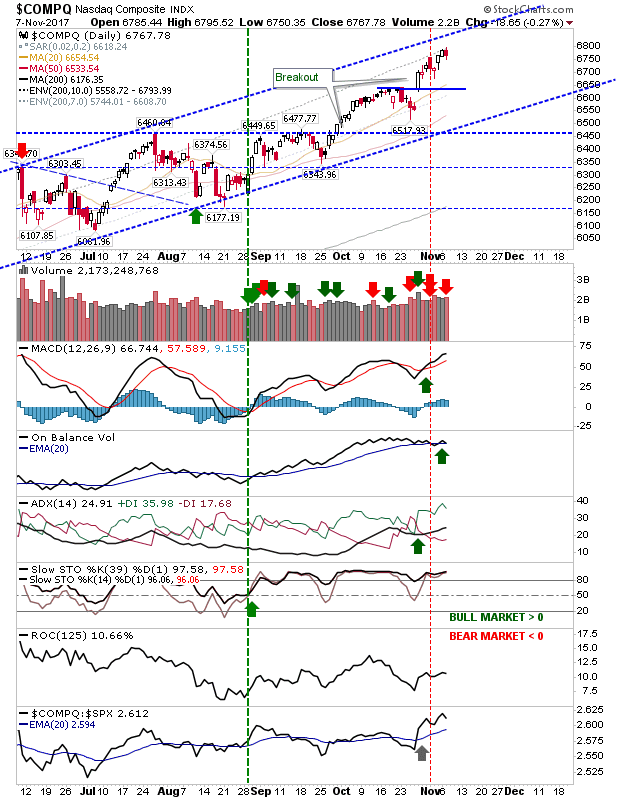

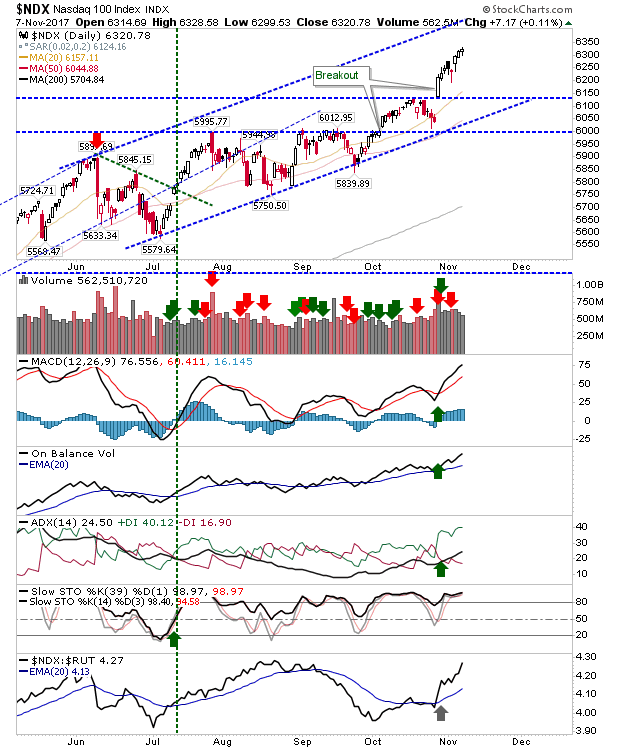

The Nasdaq experienced a little more selling than the S&P on higher volume distribution. However, technicals remain strong and the index remains on course to tag upper channel resistance.

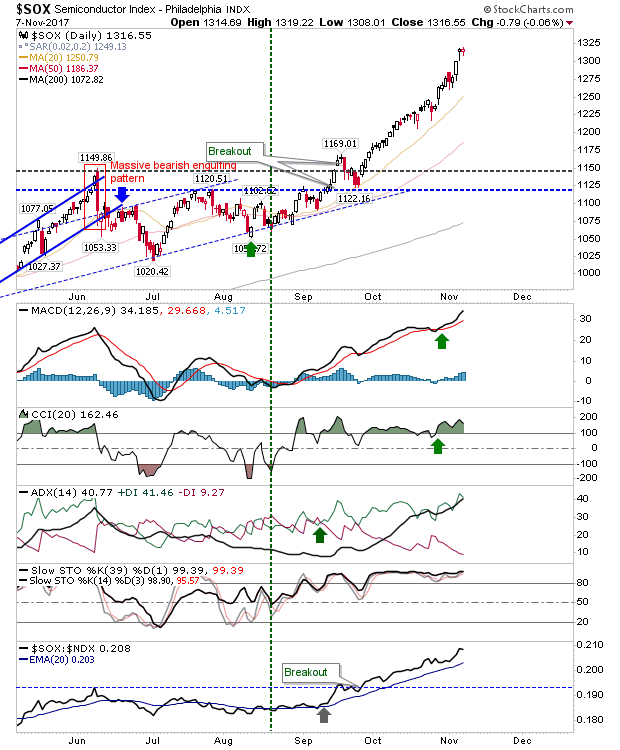

The Semiconductor Index finished with a very narrow doji at new highs. This close to parabolic run looks close to an end as relative performance against the Nasdaq 100 starts to shift away from this sector into others.

Although there was very little (really, none) hurt in the Nasdaq 100. Note how relative performance against the Russell 2000 has remained range bound for the last six months; look for a break out of this range to suggest the Nasdaq 100 will become the next market leader.

For tomorrow, keep it simple. What happens in the Russell 2000 will likely determine overall market action for the rest of the year. Small Caps typically leady the market and if ‘bull flag’ support fails I would look for profit taking to extend into Tech and Large Caps in the weeks ahead.

Leave A Comment