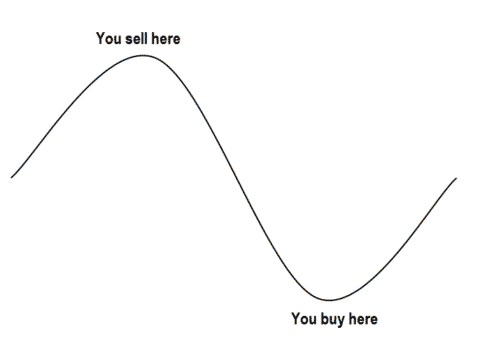

If I showed you the chart below and asked you where you should buy stocks and where you should sell stocks the answer would be obvious, right? You buy low and you sell high. Everyone knows that. Of course, it’s easier said than done, but we still know the right answer. And the reason why this is the right answer is because your risk-adjusted returns are likely to be better when you buy low than when you buy high. Again, that’s obvious.

But what about government spending? Why don’t we think of it the same way? Actually, a lot of people do and they’re called “Keynesians”.¹ It’s no coincidence that Keynes was a pretty good investor and an advocate of countercyclical policies. He understood that government spending was likely to have a bigger multiplier when the economy was weak. That’s because government spending works in much in the same way that asset allocation works (or any spending in the economy). When you spend on assets at an attractive value they tend to perform better on a risk-adjusted basis in the future.

Now, the cool thing about government policy is that you can automate all of this so that the government spends more when the economy declines in value and spends less when the economy increases in value. In fact, that’s exactly how the US government works. Economists call this “automatic stabilizers”. Basically, the way it works is that government spending is designed to increase (because demand for government income will increase in downturns) when the economy weakens. At the same time tax revenues will automatically fall because the economy is slowing and private sector incomes are declining. It’s smart policy because it is the same basic premise as buying low and selling high. In essence, the government is spending more on its private sector when it becomes inexpensive and spending less on it when it becomes expensive. You can see how this actually works below. You’ll notice that the chart spikes right at the recessions because spending is automatically increasing:

Leave A Comment