Well, geopolitics is back in the spotlight to start the week. That’s thanks in no small part to an unprecedented royal purge in Saudi Arabia, where Mohammed bin Salman is in the middle of a second push to consolidate power, this one far more aggressive than what we saw over the summer.

The most notable “casualties” (and I use that term figuratively, although some folks were killed on Sunday in a helicopter crash which will undoubtedly be seen as suspicious by anyone of a conspiratorial predisposition) were Prince Miteb bin Abdullah whose ouster as chief of the National Guard effectively means MbS now controls the kingdom’s entire security apparatus and of course Prince Alwaleed bin Talal, an international personality, famed global investor, and occasional fly in Trump’s Twitter soup. If you haven’t read our recap of Saturday’s events, you should at least skim it here.

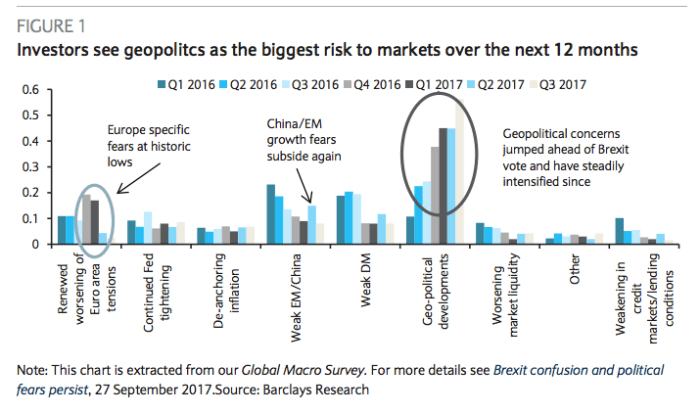

Of course contrary to what you might have heard from your favorite pundit, geopolitics was never far from the minds of serious investors. Just ask them – Barclays did:

It’s as yet unclear what the fall out from the Saudi situation will be in global markets. The initial knee-jerk was lower in Saudi shares, but by the end of the session on Sunday, a remarkable reversal resulted in a green close:

Shares of Kingdom Holding (owned by Prince Alwaleed) didn’t recover, but it’s worth noting that the stock was already woefully underperforming the broad market on the year:

Oil knee-jerked higher above $56 to start the week, but you could just as easily chalk that up to expectations that MbS will back an extension of cuts as you could to a thesis around “turmoil”:

As Barclays notes, “pivotal USD risks [are] out of the way, including the appointment of the next Fed chair, more clarity on the US tax plan and key US data,” which leaves markets to “re-focus on idiosyncratic stories.” Saudi Arabia certainly qualifies, but don’t forget that Trump is loose in Asia. “We expect President Trump’s tour of Asia to focus on the North Korean nuclear threat,” Barclays adds, in their week ahead preview, before noting that “while he’ll likely highlight a unified front with his Asian allies on the topic, we highlight risks that he could also reference the recent Treasury report, which named China, Japan, Korea, and India as countries warranting special attention on their currency practices.”

Leave A Comment