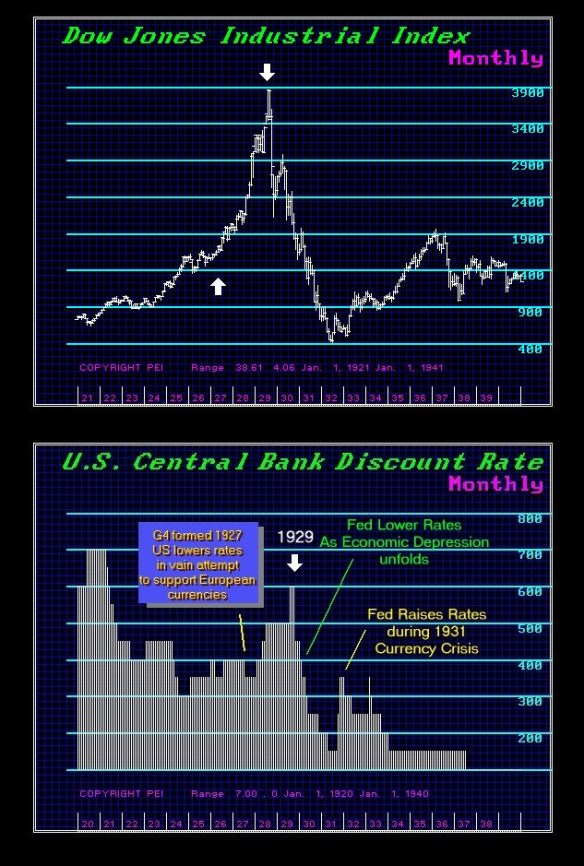

While recession has returned to Japan and interest rates have dropped to negative, in Europe the ECM has effectively announced it will expand its balance sheet again by a trillion Euro. China has lowered interest rates showing this view of lowering interest rates is believed to stimulate the economy still prevails, albeit nobody can point to any such period which demonstrates that such a policy has ever worked. The Fed lowered interest rates from the peak in 1929 to no avail. Honestly, while this may sound like good policy, it has simply never worked. Lowering interest rates HAS never created a stock bull market. Lowering interests has instead market the worse declines in history.

The problem we face today is the assumption that the Euro will not merely crash and burn, it will break-apart. We are witnessing two important shifts in capital. Pressure is still being applied to the Swiss despite the peg. They are swapping Euros for Swiss at alarming rates. In Germany, the 10 year bonds are trading through the US rates. Why? Certainly not because Germany is doing better than the USA from an economic perspective. This trade continues to assume that at the end of the day, the Euro will break-apart and they will end up with Deutsche marks. That is rather foolish for it appears that the ECB has no problem allowing the Euro to fall even below par with the dollar and in fact would welcome such a decline assuming at least then that would stimulate the economy.

Leave A Comment