Sobering economic reports leading to a rebound to the breakdown point as well as a bit more short-covering, should not alleviate concerns of progression of an ongoing Bear Market, that desperately is trying ‘not’ to challenge recent lows. In fact, the rebound was the general outline now simply allowed; but as noted all week, what should occur as the initial break below the rising bottoms or upward ‘reflex rebound channel trend-line, was penetrated.

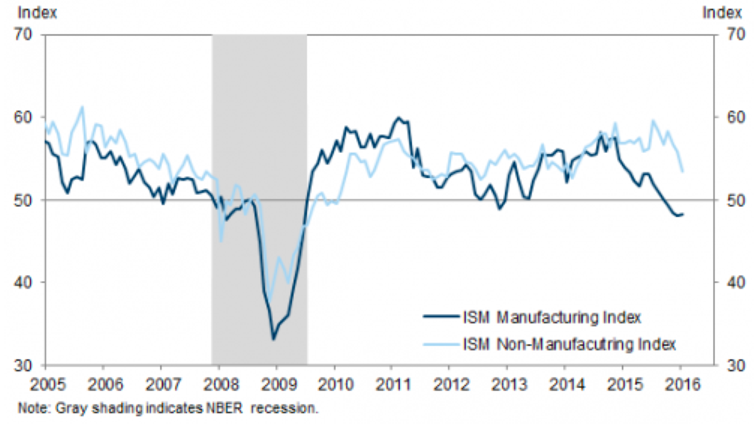

The domestic fundamentals are indeed not truly terrible; fiscal stimulus drag is out there; the lost momentum in the Service Sector is increasingly evident; the industrial sector won’t be helped much by the short-term pullback of the Dollar; as the underlying trend remains corrective actions trying to avert more decline.

So just technically, ignoring fundamentals like Oil’s sharp rebound that I’ve very much wanted to see, you have a ‘battle royale’ that we suspects resolves back on the downside, although we’ve said all-along this is a process and doesn’t at all have to see moves occur in one-fell-swoop. In fact Tuesday’s decline was at the margin more dramatic than thought it might be initially, because there really was virtually no support at levels most technicians were looking to see some.

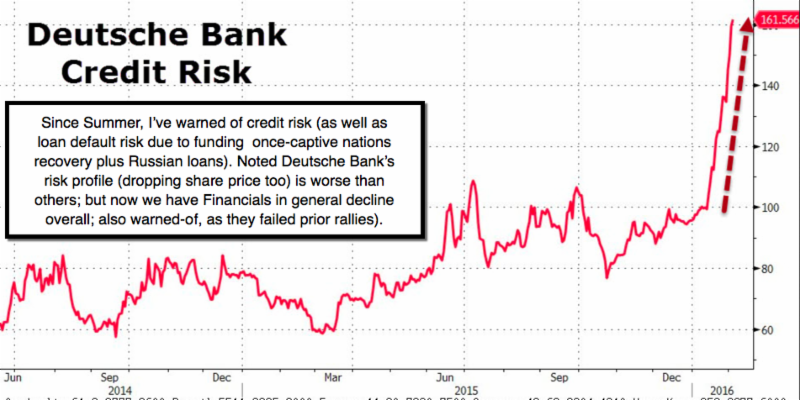

In that action, we were watching the 1900 area down to 1880 or so for some bit of holding action; and there was little at all. That allowed for a washout going in to Wednesday, especially as Tokyo led the overnight negative action, which got a bit more focus as it spread to Europe (and most banks there were down; led by Deutsche Bank, which I’ve mentioned several times was the riskiest as far as the ‘core Europe’ financials, contrasted to others in the EU’s periphery).

Across the Pond, the Euro Stoxx Bank Index is down an incredible 23% so far this year; led by Deutsche Bank of course. Italy managed to offload 350 billion Euro’s in bad loans to investors; and the Bank of Spain reports bad loans fell to just over 10% of total loans; an improvement.

So if their banks rebound, will that mean there’s not risk of further decline later? Hardly, deep restructuring has barely gotten started; given political reluctance, as well as institutional hesitation, to do what has to be done for stabilization. Of course those that put faith in ECB (Draghi) pledges to do ‘whatever it takes’ are pondering if it takes too much; and after the BoJ’s move and now fears (vague it seems) of a poor received (if not cancelled) JGB Auction, show what happens if you keep QE debt-based stimulus ongoing until the point where nobody really has interest in buying your paper; thus making it hard to service obligations.

To those who contrast the 1930’s; remember: the United States was a ‘surplus nation’ going into the Great Depression; and thus able to afford the stimulus. As a result of the money-printing insanity; neither the US nor Europe can readily at this point do a lot that would expedite economies thriving, not just surviving.

Leave A Comment