Written by Tawhid Ali, Andrew Birse – Alliance Bernstein

Solid economic growth and receding political risk continue to support sentiment towards European equities, despite the recent market pullback. As market conditions shift, a selective focus on companies with underestimated profitability is essential for investment success.

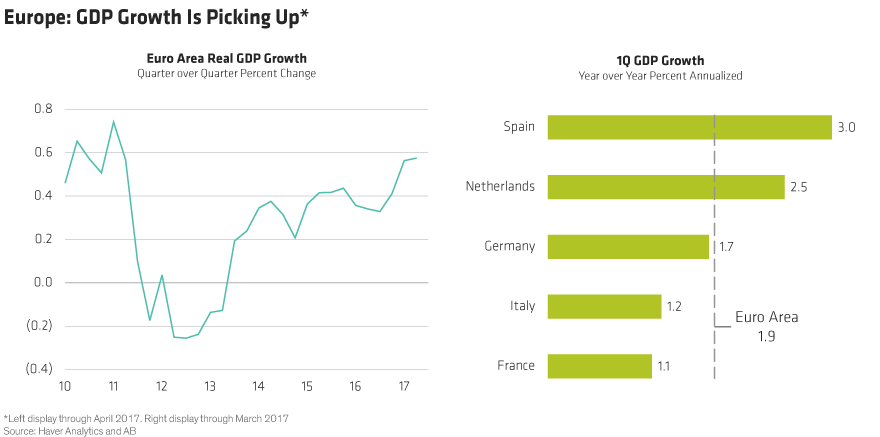

European equities have given back some gains but are still up 5.0% year to date in euro terms through August 28. Many investors remain bullish on the asset class, pointing to strong and better balanced growth in the euro area. Even countries like Italy that have been laggards in the past are now showing year-on-year growth (Display).

Diminishing Political Risk

Reduced political risk has also helped restore investor confidence. In France, the election of President Macron in May dispelled fears of a populist surge. In Germany, the region´s largest economy, Chancellor Merkel seems to be heading for yet another election victory in September. The results of a recent Eurobarometer survey, showing support for the euro hitting record highs in the core eurozone countries, are also encouraging.

In many ways, we share this optimism. In addition to the positive economic backdrop, European equity valuations remain attractive relative to US stocks and to bonds, even if they´re not cheap compared with their long-term history. But we also think a degree of caution is warranted. History shows that the performance of local equity markets is only weakly correlated with the local economy. And there may be early signs of some headwinds to earnings growth for European companies, such as the strength of the euro for exporters and recent data suggesting pricing power may be waning.

Resisting the Challenges

Identifying companies that can resist these challenges will be the key to generating strong return potential in a variety of environments, in our view. Thinking like a business owner rather than a short-term investor is a great way to find companies that can sustain strong or improving cash flows through their own efforts.

Leave A Comment