My Swing Trading Approach

I remain cautious here, as the bulls are struggling to rally the market substantially higher. Plenty of choppiness in the market. I don’t see myself adding any more than 1-2 new positions to the portfolio if conditions permit.

Indicators

Industries to Watch Today

Technology was by far the strongest sector, while staples and energy led the way to the downside. The latter of which managed to remain inside of a coiling pattern. Apple (AAPL) earnings last night, should go a long ways in helping technology once again today.

My Market Sentiment

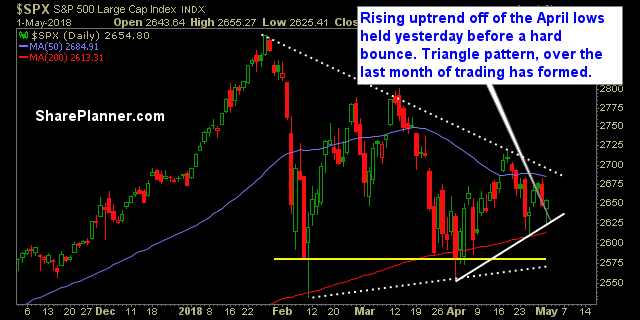

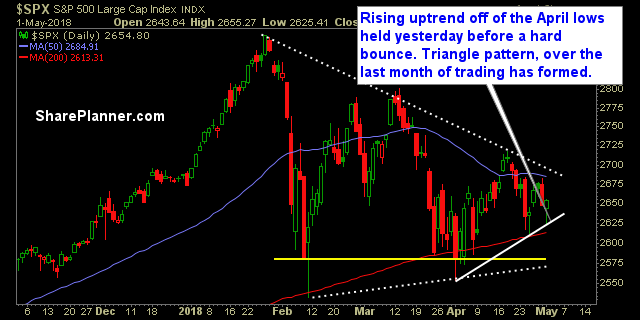

The market showed signs of wanting to break down yesterday before eventually bouncing hard and finishing the day in the green. Also, the rising trend-line off of the April lows, is proving a great deal of support in the short-term.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment