Overnight market action has largely been a continuation of Tuesday’s key themes with European stocks falling as a selloff in mining companies extended to a 7th day, even as metals prices rose and crude oil rallied modestly from a six-year low after yesterday’s API crude inventory draw. U.S. equity futures have rebounded from modest declines, as emerging-market shares extended their losing streak to a 6th day while Asian stocks dropped to 2 month lows.

The top corporate news stories include Dow Chemical and DuPont which are said to be in late-stage merger talks, Yahoo scrapping its Alibaba spinoff, and Electrolux cutting jobs after GE deal collapes, but the key macro story overnight remains China where days after the Yuan’s inauguration into the IMF’s SDR basket, the government has resumed its not so stealthy devaluation of the Yuan, which sank to the lowest level since August 2011 after the central bank cut the currency’s reference rate, despite CPI and PPI (which declined for a record 45th month) data both of which came in fractionally higher than expectations.

Bloomberg believes the move is an attempt to release pent-up depreciation pressure – call it “stealth devaluation” ahead of next week’s Federal Reserve meeting and is probably right: after all, as a result of the Yuan’s peg to the dollar the trade-weighted currency needs another 10% devaluation just to get back to even with the non-USD currencies. The People’s Bank of China cut the yuan’s fixing – which limits onshore moves to 2 percent on either side – by 0.1 percent to 6.4140 a dollar, the lowest in four years. Additionally. the onshore yuan has extended its “staircase-style” moves of past few days and dropped 0.17%, most in a month, to 6.4280; Rabobank says the pattern reflects possibility that policy makers are engineering an “orderly depreciation” before bigger move. The offshore yuan was down 0.07% to 6.4987 per dollar after hitting low of 6.5008.

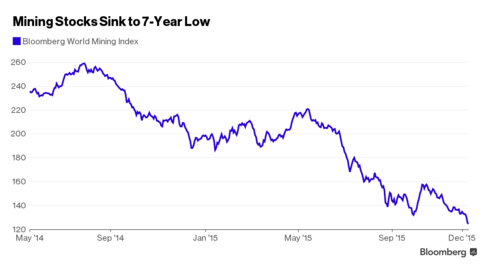

And while global markets have been largely muted overnight, the one sector that has seen particular weakness are global mining stocks which resumed their sell-off after the biggest one-day drop in over three months. The Bloomberg World Mining Index – a gauge of the world’s 80 biggest mining companies – sank almost 4 percent on Tuesday after weak China trade data.

Yesterday’s slump was compounded by news Anglo American is scrapping its dividend and slashing two-thirds of its workforce to counter a slump in commodities. Anglo shares have fallen a further 14 percent today after sinking 12 percent yesterday. The Bloomberg Commodity Index – which tracks 22 materials – has rebounded from yesterday’s lowest close in 16 years. Crude oil has bounced back from its lowest close since February 2009. It finished Tuesday’s session at $37.51 in New York, bringing the three-day decline to almost 9 percent.

And while global stocks had spent the bulkof the session in the red, an odd buying wave has emerged as a result of some modest USD strength, as US traders get to their desks this morning, leaving us as follows:

A closer look at markets shows that European stocks slid a 2nd day as commodity producers extended their lowest level in 6 years. U.K.’s FTSE 100 outperforms, Sweden and Spain bourses lag. “Sentiment is predominantly negative across markets,” Alex Scott, who helps oversee about $14 billion as Seven Investment Management’s deputy chief investment officer told Bloomberg. “Equities are still digesting further commodity- price weakness. That’s the dominant factor at present. Investors have had a difficult year and they’re struggling to see where a positive catalyst could come from.” 18 out of 19 Stoxx 600 sectors fall with chemicals, banks, basic resources underperforming and utilities outperforming. 78% of Stoxx 600 members decline, 20% gain.

Key European News:

Leave A Comment