Written by Bryan Perry

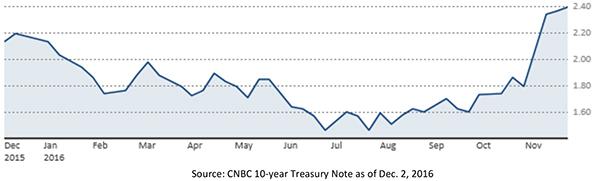

…Some very high-profile market gurus – namely DoubleLine’s Jeff Gundlach and legendary value hedge fund manager Stanley Druckenmiller – are predicting 10-year Treasury yields will rise to 6% by 2018 and GDP growth will reach the same 6% rate by 2019. Anticipation of those numbers could take the 10-year Treasury Note yield above 3% fairly soon, in anticipation of further Fed tightening.

Investors are having to rapidly adjust to this incredible turn of events in an almost overnight fashion that is very unsettling for those holding tight to their long-dated bond holdings. The only solace is that all bonds mature at par value – if you elect to hold on to long-dated maturities. Either way, the great bond rally of the past eight years is officially over – at least until the next recession comes around.

It would seem that both Gundlach and Druckenmiller are getting some early tailwinds for their forecasts. U.S. Treasuries took their cue from the economic calendar as positive news translates to a downhill slope for bond prices.

Durable goods orders jumped by 4.8% (month over month) in October (versus consensus estimates of just 1.1%).

In addition, the Commerce Department announced that GDP growth surged at a 3.2% annual pace in the third quarter, up from its initial estimate of 2.9%, as consumer spending was revised up to a 2.8% annual pace, from 2.1% initially estimated.

Also, existing home sales rose to 5.6 million in October vs. 5.49 million in September,

and corporate profits jumped 6.6% in the third quarter.

The hits keep on coming:

The Institute for Supply Management (ISM) announced that its manufacturing index rose to 53.2 in November, up from 51.9 in October. This was the highest the ISM manufacturing index has been in the past five months and well above economists’ consensus estimate of 52.5. The new orders component rose to 53 in November, up from 52.1 in October. All this is good news for continued strong GDP growth. (Source: Institute of Supply Management, December 1, 2016)

Looking forward, the Atlanta Fed’s GDPNow model forecast is now at 2.9% for fourth-quarter U.S. real GDP growth, so the U.S. economic recovery looks to be gathering speed from the sluggish pace that prevailed for most of 2016. That said, interest rate markets have priced in a lot more growth and inflation and the rationale for the Fed raising interest rates to stem inflation and rising GDP now seems inevitable.

Leave A Comment