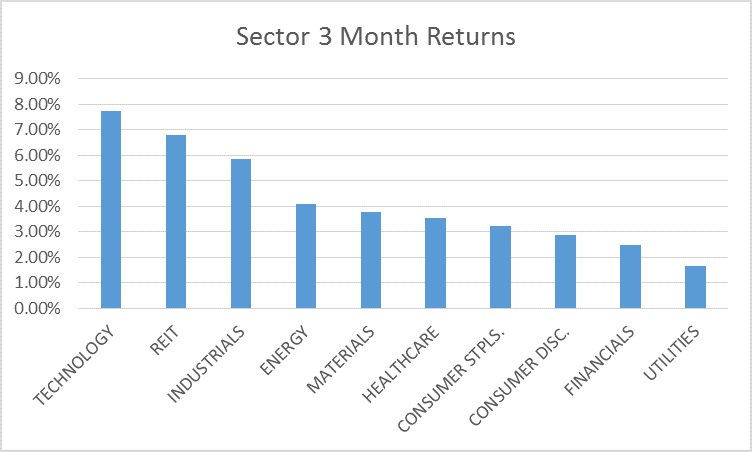

I haven’t posted on sector momentum since just after the Brexit vote because there hasn’t been much change. The most obvious change is that all sectors are now positive on a three month basis. Defensive sectors have retreated a bit and more cyclical sectors have advance a bit. The result is a market that is only slightly improved since the last update. The change in sector leadership mirrors the changes we’ve seen in the incoming economic data which has improved ever so slightly on a month to month basis.

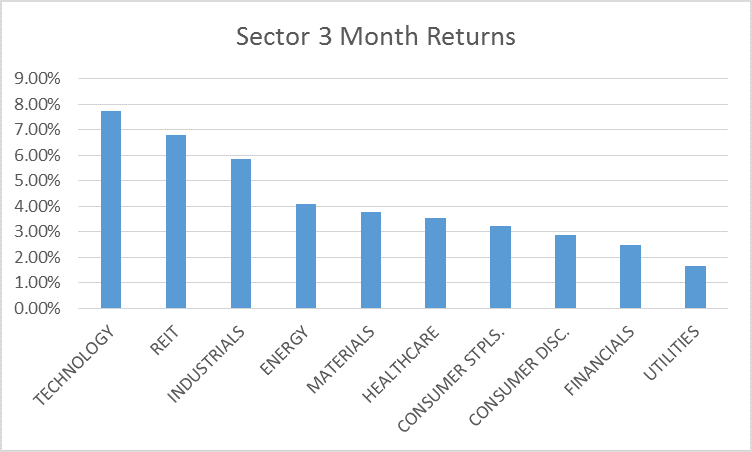

One month returns show leadership about the same, although financials may be starting to make a move. That is likely a product of rising expectations for a Fed rate hike. I’d be wary of making the leap from rate hike to improved financial profits though. Remember Greenspan’s conundrum. If the long end of the curve doesn’t rise as fast as the short end – in other words if the curve flattens after tightening – financial profits are going to take a hit. They make their money mostly on the spread between short and long rates. And yes, I expect that is exactly what will happen if the Fed hikes soon – the curve will flatten. In fact, I’d expect to see the long end of the curve rally if the Fed hikes short term rates. The economy is already pretty fragile and higher rates aren’t going to make that better in the short term.

Leave A Comment