Here is a statement of the obvious if there ever was one: The market doesn’t always do what it’s supposed to. Expensive markets are supposed to correct, and cheap markets are supposed to rally as both revert to their long-term averages. But there are long stretches of time where expensive markets get even more expensive and cheap markets get even cheaper.

In the short term, valuations really don’t matter because, as Benjamin Graham noted, the market is a voting machine ruled by emotions. But Graham also believed that over longer stretches, the market is a weighing machine that assigns the “correct” value. This is the rationale for value investing, and it’s something I firmly believe in.

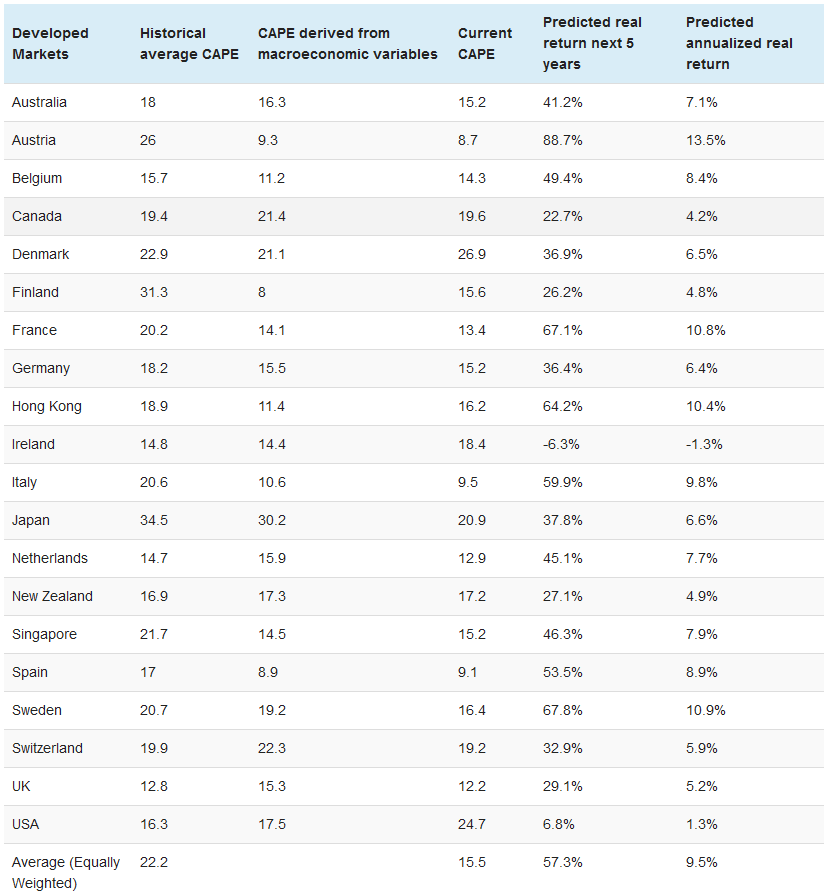

We can’t know ahead of time what the market will return over the next five years, but we certainly can look at some hypotheticals based on history. In The Next Ten Years, I shared estimates compiled by Rob Arnott at Research Affiliates that used today’s cyclically-adjusted price/earnings ratios (“CAPE”) and forecasted returns based on earnings and a regression to the long-term average valuation. Today, I’m going to share estimates by Wellershoff & Partners Ltd that add an additional wrinkle. Wellershoff adds a “macroeconomically fair CAPE” to the mix, which takes into account interest rates, inflation rates and economic growth.

Let’s start by digging into the developed world markets:

With the exception of tiny Denmark, the United States is the most expensive developed market in the world with a CAPE of 24.7. The long-term average is just 16.1…and a “fair” CAPE that would adjust that long-term rate for today’s interest, inflation, and growth rates would be 17.5. Starting at these levels, the U.S. market is priced to deliver returns of about 1.3% over the next five years.

Do I expect the S&P 500 to deliver exactly 1.3% per year over the next five years? Absolutely not. It could be much higher…or much lower. But that 1.3% figure gives us a rough gauge of what to expect as a “reasonable” return at today’s prices. (Arnott, by the way, came up with a figure of 0.7%.)

Leave A Comment