Pundits are all over the map on the future direction of the economy. Many are simply optimists (or pessimists) regurgitating baseless and emotional views. But even those with a good understanding of current macroeconomic data have differing views.

Generally, macroeconomic pundits are wary of the current situation in the USA as economic growth is so near the zero line that any misreading of the tea leaves can draw very wrong conclusions.

As an example, the NBER (which is tasked with identifying recessions) uses the big four identifiers:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.

….. The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment. In addition, we refer to two indicators with coverage primarily of manufacturing and goods: (3) industrial production and (4) the volume of sales of the manufacturing and wholesale-retail sectors adjusted for price changes.

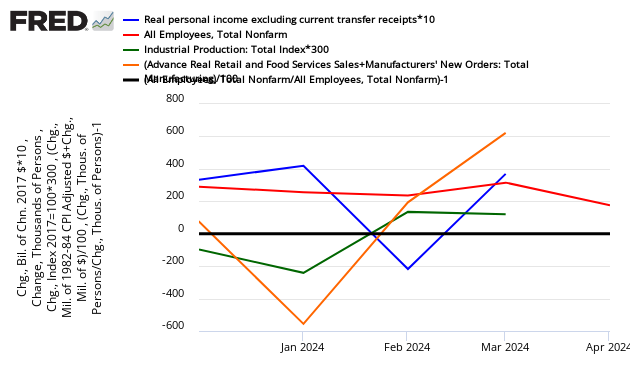

Below is a graph looking at the month-over-month change (note that multipliers have been used to make changes more obvious).

Month-over-Month Growth Personal Income less transfer payments (blue line), Employment (red line), Industrial Production (green line), Business Sales (orange line)

In the above graph, if a line falls below 0 (black line) – that sector is contracting from the previous month. At his point, although much of the data is soft, three of the four metrics show growth for the past two months, an improvement over the four preceding months. Again, this is a rear view mirror, is subject to revision, and is not predictive of where the economy is going.Another way to look at the same data sets is in the graph below which uses indexed real values from the trough of the Great Recession.

Leave A Comment