Previous:

On Wednesday the 28th of February, trading on the euro closed down. Including during today’s Asian session, the single currency has dropped to 1.2184. As the dollar was rising across board, the euro’s drop could have been more intense. It was saved by the euro/pound cross, which posted a 1% gain to reach 0.8869.

The pound came under pressure after a draft proposal on Britain’s withdrawal from the EU was published. The document has revealed deep rifts between the two sides and shows how far they are from reaching a final agreement. This could lead to even tougher terms of exit.

Aside from the dollar’s gains on all fronts, the euro also came under pressure from reduced Eurozone inflation as well as the upcoming parliamentary elections in Italy, which will be held on Sunday.

US data:

Day’s news (GMT+3):

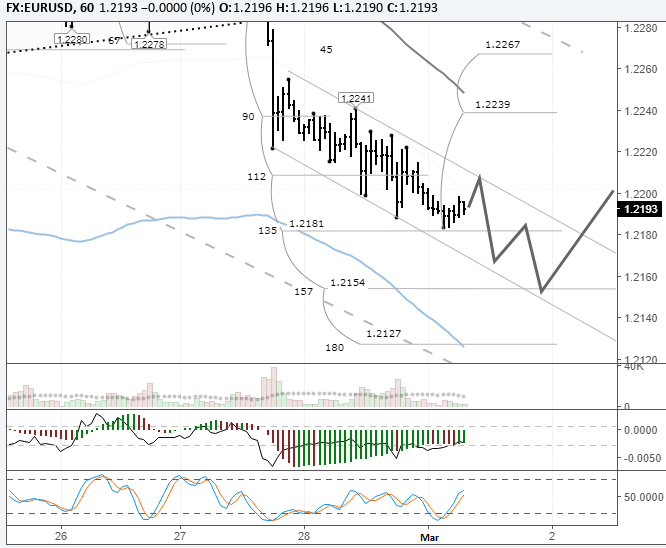

Fig 1. EURUSD hourly chart. Source: TradingView

I correctly predicted that the euro would retreat to the 135th degree yesterday. It missed my target of 1.2181 by 3 pips. Today, I think the rate will drop significantly lower than this.

Leave A Comment