After opening the day on a flat note, share markets in India witnessed some buying interest and are presently trading marginally higher. Sectoral indices are trading on a positive note with stocks in the realty sector and consumer durable sector witnessing maximum buying interest.

The BSE Sensex is trading up 68 points (up 0.2%) and the NSE Nifty is trading up 21 points (up 0.2%). The BSE Mid Cap index is trading up by 0.7%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 64.63 to the US$.

In the news from the initial public offering (IPO) space, New Delhi-based textbook publisher S Chand & Co is looking to raise Rs 7 billion through an IPO. The issue is set to open on April 26th.

The company has set the price band for the IPO at Rs 660-670 per share and the minimum bid lot at 22 shares.

The IPO includes fresh issue of share worth up to Rs 3 billion and an offer for sale (OFS) of 60 lakh shares by the existing shareholders.

S Chand is a leading Indian education content company (in terms of revenue from operations in FY16). The company delivers content, solutions and services across the education lifecycle through its K-12, higher education and early learning segments. It is the leading K-12 education content company with a strong presence in the CBSE/ICSE affiliated schools and increasing presence in the state board affiliated schools across India.

We will shortly release a note on the above IPO. To know our view on the latest IPOs, you can visit our IPO page.

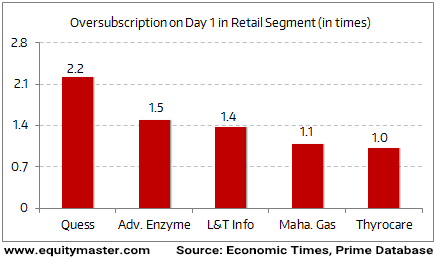

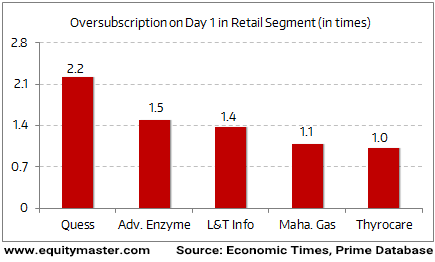

Speaking of IPOs, a dozen of IPOs are lined up in the upcoming months. And given the recent buoyancy surrounding IPOs, market participants are looking forward to most of the upcoming issues. The buoyancy in the IPO space can be seen from the huge retail participation in some of the recent IPOs.

Huge Retail Participation in IPOs

But no matter what picture the present trend paints, one should look at the fundamentals of the business and the attractiveness of valuations in each and every IPO.

Leave A Comment