Dipping back from rarefied air the market has probed, during weeks of a grind that finally made it by ‘grinding’ gradually then probing into the historic stratospheric levels we are now at, remains a prospect ahead of mid-month.

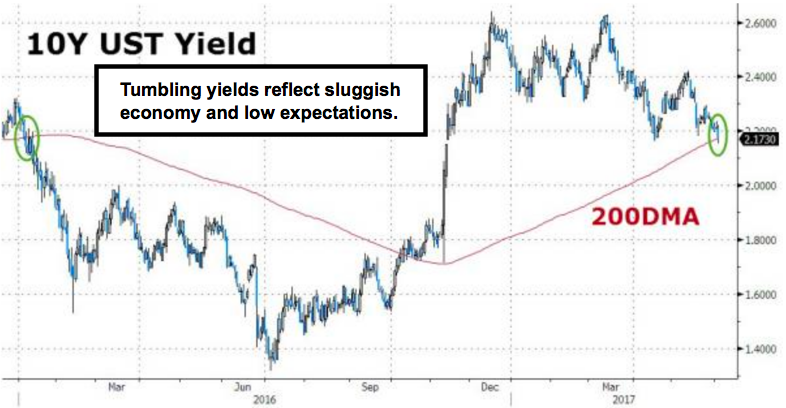

However, first we have to address the reactions from the FOMC meeting just ahead, which handily could see a reluctant rate hike given sloppy economic conditions (and mediocre jobs data not to mention slow GDP growth). What they may do is hike rates and then accompany that with a dovish statement; although if so, then the market may selloff; catch shorts yet again; and take it to new highs, providing S&P holds together until that time of the week.

Regardless we suspect this shuffles around a bit and then we have a June swoon; but with the technical cushion above key supports we’ve described, it should not be a catastrophic market breakdown, barring a ‘black swan’ or a slew of other unanticipated events.

Leave A Comment